It’s now more than 18 months since the start of the Covid-19 pandemic.

In Sydney, big swathes of the city are still in lockdown level referred to as “stay-at-home” and new cases are now topping 2,000 each day, according to Reuters.

And it’s not just Sydney. The third wave of infections, driven by the new “Delta variant” and low vaccination rates, has also severely impacted Melbourne and Canberra, forcing more than half the country’s 25 million people into strict stay-at-home restrictions.

But as the largest and most economically productive city in Australia, Sydney must be seen as a key factor when it comes to the impact the pandemic is having.

Read on for more about how the continuing lockdowns are impacting some key sectors.

Sydney – 3 more months of staying at home?

Sydney is the biggest economic driver in Australia’s most economically important state – responsible for about a third of national GDP. But the latest lockdown is hitting economic output hard.

Businesses are having to bear the brunt, and there is increasing speculation that Australia is on the brink of a second recession in as many years.

In response, the prime minister, Scott Morrison, recently announced more federal funding for smaller businesses impacted by the lockdown up to as much as A$100,000 ($74,000) a week, along with increased welfare payments for lower-income workers who have lost salaries.

This recent spending commitment now means that the federal government is spending about A$750 million a week on support for the state.

The prime minister didn’t have much positive news about the Sydney lockdown when interviewed in Canberra recently.

“We have to push through this lockdown in Sydney,” he told reporters, suggesting that “stay-at- home” orders could last to the end of the year.

The government have also announced additional funding to boost vaccine distribution and have confirmed that supplies are being flown in from the UK and Singapore to help fill the vaccine gap.

The economy – “lockdowns have caused ‘significant’ damage”

With Sydney effectively sealed off from the rest of the nation – affecting the tourism and retail sectors – it’s becoming clear that the economic impact is going to be severe. Treasurer, Josh Frydenberg, has admitted that lockdowns have caused “significant damage” to the Australian economy.

According to Commonwealth Bank of Australia, the national economy will contract by 2.7% in the third quarter.

Even some rare positive news – a drop in unemployment – was tempered by an Australian Bureau of Statistics (ABS) warning when they released the figures.

The federal spending that we highlighted above is creating a debt that will need to be serviced and paid off at some stage, which could result in future reduced business investment and higher taxes.

One bright spot is that business and personal savings are at an all-time high. This could potentially be the driver for a post-Covid boom in Sydney and elsewhere when things start to return to normal.

Travel – it’s still “Fortress Australia”

The restrictions on travel into and out of the country look set to continue until well into 2022. In the annual Budget statement earlier this year, the treasurer suggested that the existing restrictions could well remain in place until June 2022.

This policy, colloquially named “Fortress Australia”, is obviously having a big impact on business and tourism.

The impact on business

From a business perspective, online meetings are clearly useful, but not conducive to new business investment – either internal or external.

A company looking to make a big overseas property investment, for example, is hardly likely to do so based on a videoconference call or by using Google Earth. The same applies at a national level too. With lockdown meaning big restrictions on travel between Australian cities, businesses are reluctant to expand.

Kingsford-Smith is usually the busiest airport in Australia, but with anyone arriving being forced into 14 days quarantine, it’s now eerily quiet.

Qantas, who grounded their entire fleet at the start of the pandemic, have tentatively announced that they will resume overseas flights at the end of the year. But even their announcement was heavily caveated.

The impact on tourism

Pre-Covid, tourism made up more than 3% of Australian GDP.

As well as visitors from abroad, Sydney is a magnet for visitors from all over Australia. With spring here and summer on the way, hotels, bars, and restaurants would normally be gearing up for their busiest period of the year.

With an Ashes tour on the horizon, Sydney would normally expect a big financial boost from the thousands of England cricket fans turning up to watch their side lose another Test at the SCG. Not so this year.

One positive is that the situation is creating some pent-up demand that will help drive a recovery when restrictions are lifted but, against that, capacity will surely be an issue when people can eventually resume normal travel.

Investment – markets still showing sluggish growth

As well as reduced levels of business investment, lockdown is also having a negative impact on investment markets.

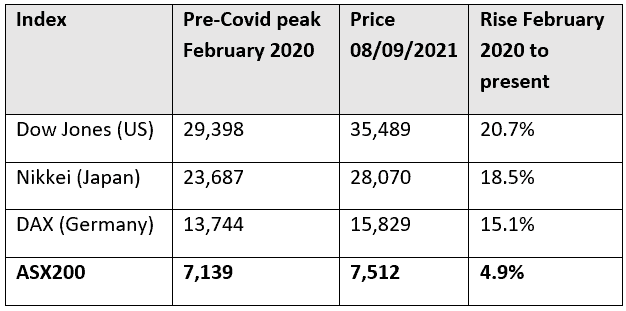

Compared to other key indices, the performance of the ASX200 has been sluggish. It’s currently 4.9% above its pre-Covid peak, which compares unfavourably to other key indices.

Another sign of the slow rate of recovery is the time it took for key markets to get back to their pre-Covid peak.

The ASX didn’t get back to its February 2020 level until 28 May 2021. By comparison, the Dow Jones (US) and Nikkei (Japan) both passed that milestone in November last year, with the DAX (Germany) following a month later.

As with travel and tourism, it’s possible there’s some built up demand in the system that could herald a post-Covid market boom, but it’s currently unclear when that could arrive.

Get in touch

We can’t help you escape from lockdown, but we can help you manage your investments in the best way possible to help whether the current economic downturn.

Get in touch to find out how we can help you.