Looking to access your Australian super from the UK?

If you’ve spent time working in Australia on a permanent visa it is likely that you’ve accumulated a significant superannuation fund. Find out more about how we can help you access your money in the most tax-efficient way possible.

Cross-border retirement planning

If you are an Australian living in the UK, or a Brit returning to the UK after working in Australia, then your retirement planning could be much more challenging as a result.

There are multiple things to consider, including UK Pension Freedom and the various ways that you can draw an income.

Added to this you may also need to consider any sources of income in Australia, the different retirement ages for each country, and two very different taxation systems.

Here’s how we can help you…

Superannuation transfer advice

We have a wealth of experience in advising people wanting to access their superannuation while living in the UK.

Importantly, we can help you access the most tax-efficient methods of extracting lump sums and drawing an income from your accrued super fund.

We can also ensure that your portfolio is efficiently invested and help reduce the risks associated with currency conversion.

We can also advise on the exceptional circumstances where your pensions and superannuation can be accessed earlier than your normal retirement age, and the taxation consequences of doing so.

WHEN YOU CAN GET YOUR SUPER

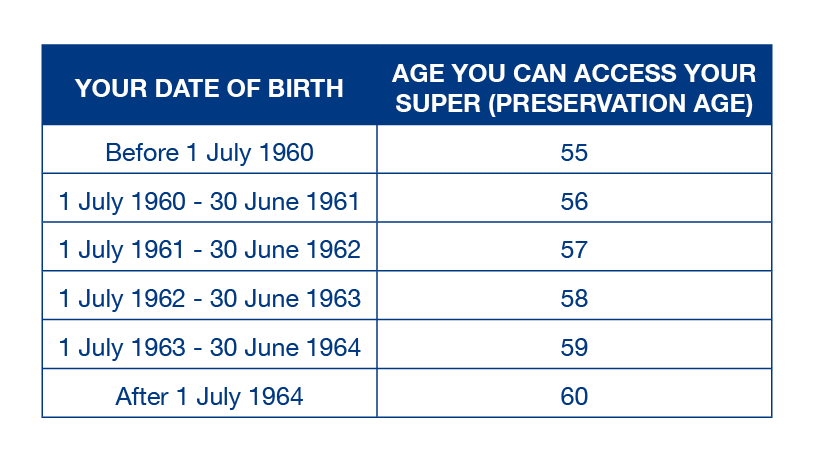

You can withdraw your super once you’re 65, even if you’re still working.

If you retire before you turn 65, you can get your super when you reach your ‘preservation age’.

Your preservation age depends on when you were born.

Creating a highly tax-efficient withdrawal strategy

All the complex variables associated with withdrawing a pension abroad, mean that creating a tax-efficient income can be complicated and potential confusing.

We have licences in both the UK and Australia for full financial planning and can help you navigate the complexities of cross-border finances to develop a clear plan.

At bdhSterling we can help you plan ahead and create a personal withdrawal strategy, taking into account different tax regimes, and your current and future income requirements.

Not ready to retire yet?

Even if you have no immediate plans to start drawing a retirement income, it is crucial to ensure your portfolios in both the UK and Australia are invested to provide the best returns based on your future income strategy and attitude to risk.

We can help you develop a robust and flexible investment plan to maximise growth and put you in a strong position when you finally decide to stop working and enjoy the retirement you’ve worked hard for.