In the 12 months up to March 2022, £6.1 billion was paid to HMRC in Inheritance Tax (IHT). That’s an increase of more than 12% on the corresponding figure for the previous 12 months.

The amount of IHT paid is expected to go up each year due to the freezing of the IHT allowance until at least April 2026, and increasing property values.

In a recent article, you read about why your domicile status is so important when it comes to the issue of IHT in the UK.

If you are an Australian living in the UK with UK domicile, IHT is something you need to be very much aware of.

So, following on from that original article, here are some simple estate planning steps you can take to ensure that as much of your estate goes to who you want it to, rather than HMRC.

1. Understand how IHT is charged

One of the keys to IHT planning is to have a clear understanding of how it’s charged and how it can impact the value of your assets when you die.

In very simple terms, IHT will be payable by your beneficiaries after your death at 40% of the value of your estate above the nil-rate band (NRB).

The current NRB (2022/23) is £325,000. As you’ve already read, that figure will apply until April 2026.

On top of your NRB, you also have a residence nil-rate band (RNRB) which is currently £175,000, assuming that your home passes to your children or grandchildren on your death.

If you’re married and pre-decease your partner, they will be eligible for the “spousal exemption” which means that all your assets will pass to them with no IHT being charged.

A key point to remember is that both you and your partner must be UK domiciled for the spousal exemption to apply. If that isn’t the case, things can get very complicated.

Given the complexity, we would strongly recommend that you take advice from a financial planning expert in these circumstances.

2. Use gifts to reduce the amount of IHT payable on your estate

One of the easiest ways to reduce the overall value of your estate, and therefore reduce your IHT liability, is to give your assets away. This is known as “gifting”.

You’re entitled to make certain small gifts each tax year which immediately fall out of the value of your estate. These gifts include:

- Your annual exemption, currently up to £3,000 a year

- Gifts in respect of a wedding; up to £5,000 to a child from parents, £2,500 to a grandchild or great-grandchild, and £1,000 to anyone else

- £250 a year to anyone else who you haven’t given a gift.

You can also gift money to political parties and registered charities, and this will fall outside of your estate for IHT purposes.

3. Make use of PETs

Beyond the gift allowances you read about in the previous section, you’re theoretically allowed to gift as much of your estate as you want. Such gifts are known as “potentially exempt transfers” (PETs).

The key word to note here is “potentially” because, for such a transfer of assets to be totally free from IHT, you need to live for seven years from the date you make the transfer. Hence an expression you may have heard – the “seven-year rule.”

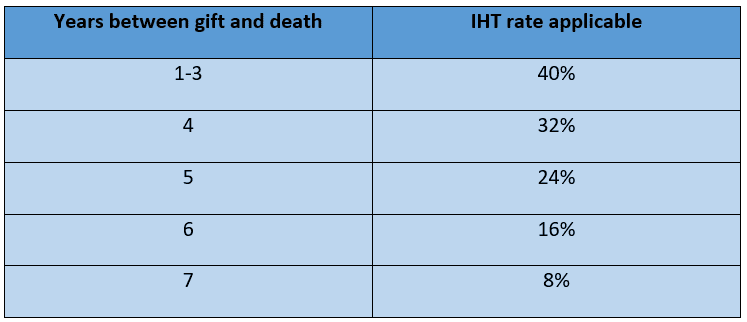

Before then, the amount of IHT payable tapers down depending on the length of time between the gift and your death.

Note that this taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it doesn’t exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.

As you can appreciate, the existence of the seven-year rule makes advance planning when it comes to PETs essential.

4. Make sure you have a will in place for each tax jurisdiction

Even if you already have a will in place in Australia, you should make it a key priority to have a separate one set up to cover your UK-based financial assets.

Making a will is one of the most straightforward financial processes, yet Law Society research shows that nearly 60% of people in the UK currently don’t have one in place.

Having a will ensures that your wealth passes to the people you want it to and in a timely manner.

It also means that any challenges to the distribution of your wealth are less likely to succeed.

If you are married or in a civil partnership your spouse or partner should make a will too.

5. Develop a tax-efficient strategy for taking your income

When it comes to IHT planning, a crucial point to note is that the remaining value of your UK pension won’t typically be subject to IHT on your death, subject to the tax status of your beneficiaries.

It can therefore make financial sense to plan where you draw retirement income from. Non-pension savings and investments will be subject to IHT, so by taking income from these first you may be able to reduce your IHT liability.

As it’s not possible to transfer the value of any Australian super you hold to a UK pension arrangement, you’ll need to plan your income carefully.

Again, we’d strongly recommend you seek expert financial advice.

6. Use trusts to reduce your IHT liability

Trusts are legal documents, used to pass property or other assets from yourself to a trustee. The trustee will then manage the assets on behalf of whoever you determine is the beneficiary.

The key point from an IHT point of view is that once an asset is part of a trust, it’s usually no longer included in the value of your estate when it comes to calculating your IHT liability on death.

Trusts can therefore be an effective way to distribute wealth to your chosen recipients and help reduce the value of your estate that will be liable for IHT.

Common trusts used for estate planning include a bare trust – where assets are held by the trustee until such a time as the trust stipulates they are to be passed to the beneficiary – and discretionary trusts where the trustee has discretion on who the assets are given to.

An additional trust option to consider if you’re currently not UK domiciled but will be in the future is an excluded property trust. By placing assets in such a trust, you can ensure that, when you are eventually domiciled in the UK, the assets within the trust will remain exempt from IHT.

Get in touch

Estate planning can be a complex subject and mistakes can often prove costly with your heirs being faced with a substantial tax bill. If you have assets in both Australia and the UK, that adds an extra layer of complexity.

We can help you with all aspects of estate planning and are uniquely placed to support you, with offices in the UK and Australia.

Get in touch to find out how we can help you.