Everyone makes mistakes. Most are easily rectifiable with a bit of time and effort.

But when it comes to financial mistakes, they can be costly, and it can often be more difficult to put things right.

Discover more about seven of the most common financial mistakes you can make, and how you can avoid them.

1. Not having an emergency fund set up

One of the most common mistakes is to not have an emergency fund set up for you and your family.

You’re always living with the possibility of a big household emergency, which may well require immediate access to a substantial sum of money to sort out.

A common solution for many people is to simply use a credit card to cover the expense. But with interest rates on unsecured borrowing rising, it makes far more sense to have an emergency fund in place, rather than incur unnecessary cost.

The normal recommended amount is between three and six-months’ net household income. You should ensure it’s in an instant access savings account so that it’s immediately accessible when you need it.

2. Not prioritising clearing your debt

Even the most detailed financial plans can be difficult to carry out in practice if you have too much debt.

When considering debt, it’s important to separate the good from the bad.

A mortgage to buy your own home is often seen as “good debt”. Interest rates are lower than they are on the average credit card, and you’re paying for a tangible asset that could well appreciate over time.

Unsecured debt, such as credit or store cards, is a different issue. Interest rates can often be eye-wateringly high, and you can end up paying substantial amounts each month just to cover the interest, let alone the outstanding capital sum.

It’s money that you could better utilise elsewhere, which is why you should make keeping credit card debt levels as low as possible one of your top priorities.

Make sure you have a plan in place, targeting the highest interest debt first.

3. Not thinking of your legacy

It’s obviously not easy thinking about your death. But by making the mistake of not planning for what happens to your wealth and assets when you die, you can end up creating big problems for your loved ones.

A key first step is to ensure you have a will in place. Even though it’s a very simple process to set one up, Will Aid estimate that only half the UK population have one.

In your will you can specify how your assets should be distributed when you die. If you don’t set one up, a court-appointed solicitor will make decisions. This can lead to problems for your family and can also cause a delay in the distribution of your wealth.

If you already have a will in place, it’s always worth reviewing it regularly to ensure you’re still happy with the contents.

4. Not contributing to a pension

Not having pension arrangements in place to provide you with a decent income after you retire is a mistake that could leave you struggling to make ends meet once you stop work.

The current maximum State Pension – which is subject to your National Insurance contribution (NICs) history – is just £185.15 a week. Although this is a useful financial underpin, it’s probably not enough to live comfortably on in your retirement.

By making contributions to your own pension fund, you can ensure that you’ll be able to live the retirement you’ve thought about, rather than having to count every penny and worry about your financial future.

5. Delaying paying contributions into your pension fund

In addition to not having a pension in place at all, another common, pension-related, financial mistake is to delay making sizeable contributions to your plan and, instead, spending the money elsewhere.

The sooner you start contributing, the sooner your money can start accumulating investment growth.

If you delay contributions with the intention of making up for lost time at a later date, you’ll end up having to contribute more to accumulate the same sum.

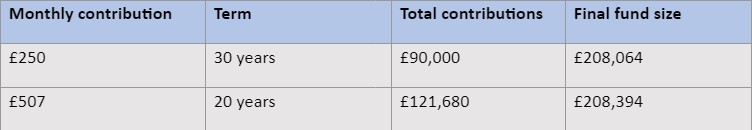

In the table below, you can see the cost of delaying contributions. These figures assume an annual investment return of 5% before any fees or charges.

Source: Calculatorsite.com

A delay of just 10 years can result in you having to pay more than double the amount each month to achieve the same result – and 34% more in total.

6. Failing to claim free money from the government

If someone was to offer you free money, with no hidden catches or strings attached, you wouldn’t say no.

When that money is coming from the government you’d surely jump at the chance.

Yet a remarkably high number of people don’t claim their free money – in the form of pension tax relief – when they can. Last year, PensionsAge reported that no less than £2.5 billion of higher-rate tax relief went unclaimed over a four-year period between 2016 and 2019.

Basic-rate tax relief is typically added at outset. This means that for every £80 you contribute, the government automatically top this up to £100 without you having to do anything.

However, you need to claim higher rates of relief through your self-assessment tax return. It’s a straightforward process that can also help keep your tax affairs in order, so it’s worth completing your return as soon as you can after the end of each financial year.

Once you’ve claimed higher rates of relief you can put the money to work.

7. Holding too much of your savings in cash

A sudden financial crash can be alarming. You’ll read financial headlines highlighting the notional amount of money that has been lost. You’ll also probably see the value of your own investment portfolio – savings and pension – decline suddenly, which can be unsettling.

However, the nature of stock markets means that their value can fluctuate regularly, as the underlying components increase and decrease in value. Alarm often emanates from the fact that market falls can be sudden, whereas increases in value tend to be over a longer term.

In reality, high rates of inflation could be more of a threat to your wealth. This is because inflation reduces the spending power of your money and those reductions are not reversed, unless we have a very rare period of negative inflation.

This means that holding too much money in interest-bearing savings accounts can be a costly mistake. Interest rates are nearly always lower than inflation, so the spending power of your money is reduced year-on-year.

If your time frame is five years or more, investing your money rather than saving it, could prove a better financial option.

Get in touch

If you’d like to talk to us about any of the issues you’ve read about in this article, please get in touch with us.

Please note

The value of your investments can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not solely rely on anything you have read in this article and ensure that you conduct your own research to ensure any actions you may take are suitable for your circumstances. All contents are based on our understanding of HMRC or ATO legislation, which is subject to change.