If you’re an Australian living in the UK for an extended period, or a Brit with relatives living in Australia, it’s very possible that at some stage you’ll receive an inheritance from a family member back in Australia.

As you would expect, given the fact that the inheritance could have been accrued under one tax regime and you’re currently living in another, how you deal with this isn’t always straightforward.

Here are six important issues you’ll need to bear in mind, and that should help you manage your inheritance to avoid any costly mistakes.

1. You’ll need to inform HMRC about your inheritance

Although the assets you receive were previously owned by another person, you still have an obligation to inform HMRC of your inheritance.

This is even the case if you believe that no tax is payable on the money, or other assets you have received.

You should note that, if any tax is due, you’ll be expected to pay the this within six months of the date of the death of your benefactor, rather than from when you actually receive the inheritance.

2. The domicile of your benefactor is all-important

When it comes to managing your inheritance your residency status is actually less important and relevant than that the domicile status of the person you’ve inherited from.

If they were domiciled in Australia, then no Inheritance Tax (IHT) will be payable.

But, even if they were residing in Australia, it’s possible that they may still have been considered as UK-domiciled for tax purposes. If that is the case, then IHT liability could well be an issue.

You also need to bear in mind that, as a non-resident beneficiary of an Australian estate, you may well be affected by Australian Capital Gains Tax (CGT) rules which act in a similar way to IHT in the UK.

CGT, IHT and domicile, can all be complicated issues to anyone not experienced in such matters. We would always strongly recommend that you get specialist advice from a tax expert.

3. There could be taxation issues around any property you inherit

If you are a UK resident and you inherit a property (or properties) in Australia you won’t be liable for CGT, Income Tax, or Stamp Duty when you take ownership of the property.

However, if you decide to sell the property, you could be liable for CGT on the sale value if it’s not your main residence at the time of sale.

It’s also important to remember that there may well be an IHT liability if the deceased was UK-domiciled.

If you decide to use the property as a rental asset to raise income, you’ll obviously be liable for Income Tax on any rent you receive.

Again, we’d strongly recommend you speak to a tax expert regarding these issues.

4. The process of moving money to the UK

If you’ve inherited a substantial sum of money that’s currently in Australia, it’s likely that at some stage you’ll want to move some, or all of it, to the UK.

In a recent article, you read in some detail about the issue of currency transfer and some of the issues involved with moving large sums of money between different countries.

In particular, fluctuating exchange rates can affect the cost of buying currency over relatively short periods of time and therefore impact on the amount you’ll receive.

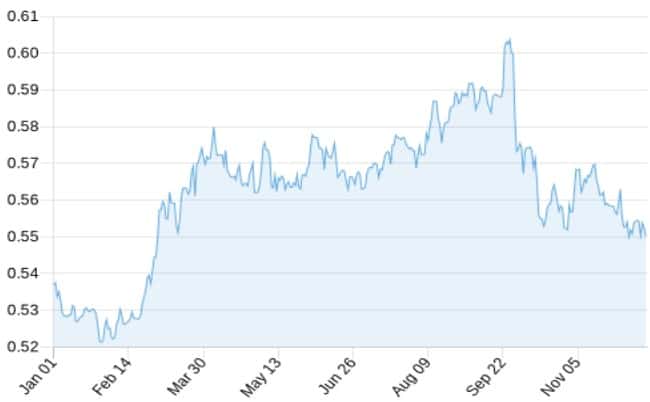

As you can see from the chart, the value of sterling against the Australian dollar has fluctuated by 9% in the last six months. If you’re transferring a large sum of money between Australia and the UK, such fluctuation could have a real impact on your wealth.

Source: Exchangerates.org.uk

We would therefore recommend you use a currency broker for such transfers. Doing so will often ensure you get the best possible rate on your money.

5. Leaving some or all of the money in Australia

Your future plans and current financial position may mean that you’ll want to leave some of your inheritance in Australia.

There will be no IHT to pay but, as you’ve already read, as you will be a non-resident beneficiary of an Australian estate, you may need to pay CGT on the value of assets left to you.

The rules around CGT payable on inherited assets, and strategies to minimise it, can be complicated. Again, we would always therefore recommend you get specialist advice from a tax expert in this regard.

6. Your inheritance is likely to affect your estate planning process

If you’re inheriting a substantial sum of money, along with any other assets, you’ll need to consider how this sum will affect your own estate planning.

For example, a big sum of money could create an IHT liability on your estate. You may therefore want to consider gifting some of your inheritance, either within the allowance limits set out by HMRC or as potentially exempt transfers (PETs) for larger sums.

You may also want to think about putting some of your assets in trust, as trusts are usually exempt from any IHT consideration.

Get in touch

Dealing with an inheritance you receive isn’t always a straightforward process, and we would strongly recommend you get expert advice. If you’d like to discuss your own situation, please get in touch with us.

Please note

The value of your investments can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not solely rely on anything you have read in this article and ensure that you conduct your own research to ensure any actions you may take are suitable for your circumstances.

All contents are based on our understanding of ATO and HMRC legislation, which is subject to change.