If you’re thinking of moving to Australia, and have an accrued UK pension fund, it’s likely you’ve wondered what you can do with your fund when you move.

Likewise, you may be an Australian planning on returning home with a fund you’ve built up after working in the UK.

In each case, one potential solution is to transfer your UK pension into an Australian super fund.

However, every decision to transfer will be unique, and there will be circumstances when a transfer is not the right choice. There could also be times when a transfer is not possible.

Read on to discover some of the key issues around transferring your UK pension to Australia.

1. There can be big tax advantages if you transfer your UK pension

If you’ve contributed to a UK pension you will have benefited from the advantageous tax treatment on UK contributions in the form of tax relief at your marginal rate.

When you come to take your pension, 25% will normally be tax-free but you may pay Income Tax on the rest.

In contrast, contributions to an Australian super are generally taxed as they are made, but then withdrawals from the fund are free of tax.

So, by transferring your UK pension to a super, you’ll create a highly advantageous tax position for yourself.

You’ll benefit from tax-incentivised contributions on the way in, and then no tax on the way out. Truly a “best of both worlds” scenario.

You will only pay tax on the growth in the value of the fund between when you arrive in Australia and when the transfer to a super fund takes place.

2. Transferring your fund can help protect its value

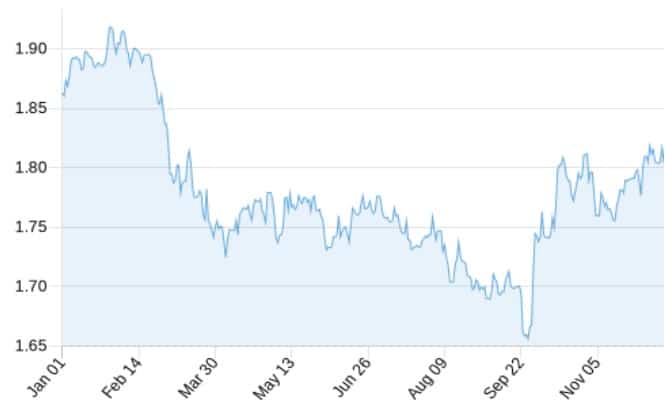

If you’re living in Australia and don’t transfer your pension fund, when you start taking money from it the sterling to Australian dollars exchange rate means the amount of income you get will vary each time you draw income. This could easily affect the value of your pension.

The table below shows the sterling to dollar exchange rate over the last year. The rate has fluctuated by more than 15% during that time.

Source: Exchangerates.org.uk

Not knowing how much of your fund you’ll need to cash in to provide a regular income could create uncertainty and make it difficult for you to plan ahead.

By transferring your full UK pension to an Australian super, you avoid that risk.

3. You can consolidate all your UK pension funds into a single super fund

If you have several different UK pension funds, you’ll know how difficult it can be to keep tabs on them all.

By transferring your UK pension to a super, you’ll be able to have all your funds in one single plan.

This can make it much easier to keep track of what you have. It can also mean you’ll have better control of your investment strategy with just one pot to invest.

It will also make it much more straightforward to manage the income you are taking.

However, there are disadvantages to consolidating pensions so, once again, it can pay to seek professional advice.

4. But transferring isn’t always the right thing to do

As with most issues in financial planning, there is no “one-size-fits-all” solution. That’s certainly the case when it comes to transferring your UK pension, because in some instances it may not be the right thing to you to do given your individual circumstances.

For example, you may have some doubts over where you’ll be living in the future. If that’s the case, and there’s a chance you may be returning to live in the UK at some stage, then transferring your pension funds may not be a prudent decision.

You could also find that the cost of transferring could be prohibitively expensive, especially if your fund is relatively small.

Regardless of your circumstances and future plans, we’d stress that getting expert advice before you do anything is close to being essential. Making the wrong decision could prove costly and it’s likely that any mistakes you make will be irreversible.

5. Not all UK pensions can be transferred to a super

Most money purchase company pension arrangements, private pensions you’ve contributed to yourself, and funded public sector defined benefit schemes can usually be transferred. Although in some cases there may be exceptions to this.

However, the following pensions cannot be transferred to a super fund:

- Government unfunded pensions, such as the NHS pension scheme

- A company pension from which you’re already taking a pension

- Company pensions that are in the PPF (Pension Protection Fund)

- Annuities you’ve purchased with a life insurance company

- Your UK State Pension.

In the case of your State Pension, while it can’t be transferred, it can be paid to you in Australia. But you should be aware that it will not increase in payment each year.

6. Your age could affect your transfer process

You need to be over 55 before you can transfer your accrued UK pension to a super.

If you’re not yet 55, one interim option is to transfer to a self-invested personal pension (SIPP) in the UK. Importantly, this gives you full control of your investments, and also enables you to start to invest in some Australian funds if you so wish.

Once you reach 55, you can then transfer to a super by using a qualifying recognised overseas pension scheme – known as a “QROPS”.

A QROPS is a scheme that complies with HMRC guidelines regarding overseas pensions.

Get in touch

As you’ve read, expert advice when it comes to transferring your pension is important. If you want to discuss any of the issues you’ve read about in this article, please get in touch with us.

Please note

The value of your investments can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not solely rely on anything you have read in this article and ensure that you conduct your own research to ensure any actions you may take are suitable for your circumstances. All contents are based on our understanding of ATO and HMRC legislation, which is subject to change.