On Tuesday 14 May, Australian Treasurer, Jim Chalmers, delivered his third Federal Budget since the Labor Party came to power in May 2022. As was widely expected, the 2024 Budget sets out the government’s priorities for their re-election campaign in 2025.

The Budget was delivered against a backdrop of global uncertainty and slowing economic growth, both in Australia and around the world.

There are also ongoing domestic challenges from the rising cost of living and high interest rates.

The economic backdrop to this Budget statement

According to the Australian Bureau of Statistics, over the 12 months to the March quarter the Consumer Prices Index (CPI) was 3.6%, down from 4.1% from the December quarter.

While this contrasts favourably with the inflation rate of 7% at the time of the 2023 Budget, interest rates on the other hand have remained stubbornly high. The Guardian reports that, in May, the Reserve Bank kept the cash rate at 4.35% for the fourth consecutive month.

In his Budget speech, Chalmers revealed that economic growth is forecast to be 1.75% in this financial year, and 2% next year.

For the second consecutive year, the Treasurer was able to announce a budget surplus, although this is a lower amount of $9.3 billion, compared to $22.1 billion at the same time last year. While this budget presents a surplus, future years budget forecasts are indicating a deficit.

Read about some of the key Budget announcements that could affect your personal finances and planning process.

Income Tax changes from 1 July 2024

The sweeping tax cuts that were announced in the 2023 Budget statement were amended in February 2024.

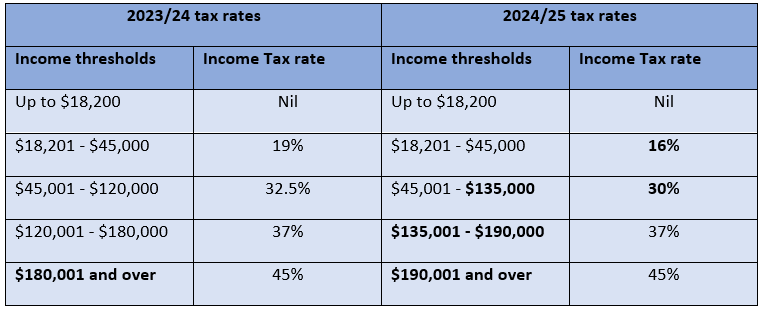

The key changes are:

- Anyone earning between $18,201 and $45,000 a year will see their 19% marginal tax rate reduced to 16%

- The 32.5% rate has been cut to 30% and the bracket expanded from $120,000 to $135,000

- The 37% tax bracket, which was due to be abolished, has been retained

- The threshold for the 45% top tax rate has been reduced from $200,000 to $190,000

The table compares the current rates with those that will apply from 1 July. The figures in bold are the changes that will be applicable.

Source: Australian Tax Office

According to the Guardian the changes mean middle and high-middle income households – with average annual incomes of $97,000 and $136,000 respectively – will enjoy the largest average gains.

Superannuation on paid parental leave

To address the wide disparity in retirement income between men and women – now at 25% – the government will spend $1.1 billion over four years from July 2025 to pay super on government-funded paid parental leave.

Eligible parents will receive an additional payment based on the Superannuation Guarantee as a contribution to their superannuation fund.

A new Capital Gains Tax regime for foreign residents

Foreign residents in Australia will be subject to a more stringent Capital Gains Tax (CGT) regime, more in line with what Australian residents pay, affecting the tax they pay when selling property and shares.

The new regime will apply to CGT events after 1 July 2025 and is intended to clarify the assets that CGT will be payable on.

The government have set aside $8 million to implement these changes and expect to raise $600 million through them in the next five years.

Extension on the “deeming rate” freeze on social security

To support pensioners who rely on income from financial investments, the government will freeze the rate investments are assumed to have appreciated – known as the “deeming rate” – for a further 12 months.

The current rates of 0.25% up to $56,400 and 2.25% thereafter will remain at their current levels until 30 June 2025.

The freeze was due to end on 30 June 2024, and the extension is designed to help retirees to manage ongoing cost of living pressures.

A $2.2 billion package to improve Aged Care

Older Australians will have access to 24,000 new home care places to support them staying in their own house rather than entering an aged care facility.

This is part of a $2.2 billion package delivering recommendations from the Royal Commission to improve services.

All households and businesses will benefit from an energy rebate

From 1 July 2024, all Australian households will receive an energy rebate of $300 while eligible small businesses will receive a $325 rebate.

You will not need to apply for this as it will be automatically applied to your electricity bills over the course of 12 months.

More than 10 million households are expected to benefit from this measure, alongside 1 million small businesses.

The Treasurer did not address some key Financial Planning issues

From a Financial Planning perspective, this Budget was probably more noteworthy for what wasn’t announced rather than what the Treasurer actually stated.

Some of the issues we might have expected to be addressed, but were not, included:

- Division 296 tax measures relating to additional taxation on your super fund if your balance is in excess of $3 million

- The indexation of transfer balance caps and total super balance thresholds

- An update on the time frame for legacy pension conversions or self-managed superannuation fund (SMSF) residency changes

- The pending increase in the Superannuation Guarantee from 11% to 11.5%

- The age from which you can generally access your super to become 60 for all Australians.

Given the silence on these points, we think it’s safe these will proceed based on previous announcements made.

Get in touch

We will cover any key issues that may affect you at your next annual review, but, in the meantime, if you have any particular concerns please get in touch with us.

Please note

These changes are currently only proposals and are subject to legislation.

This article is for information only. Please do not solely rely on anything you have read in this article and ensure that you conduct your own research to ensure any actions you may take are suitable for your circumstances.

All contents are based on our understanding of ATO legislation, which is subject to change.