According to investment data provider MSCI, the idea of ESG or “socially responsible” investing started all the way back in the 1960s.

But now, allowing investors to align their investments with their personal values is an industry worth billions of pounds.

Read on to discover what it means for a company to be considered an “ESG investment”, how they can be useful to you, and the issue of “greenwashing” that continues to plague ethical investing.

Decoding the “E, S and G” in ESG investments

To understand the value of ESG investments, it’s first important to know what it actually means for an asset to be considered to have good ESG credentials.

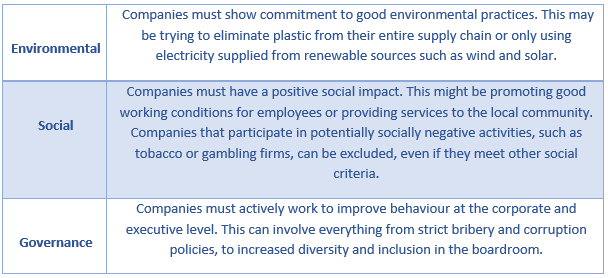

Standing for “environmental, social, and governance”, the ESG acronym is a label applied to companies that meet specific ethical criteria in at least one of these three categories.

The table below offers a quick round up of the major factors that influence investment houses, fund managers, and ratings firms when deciding whether a company meets the ESG criteria:

These labels, often provided by third-party ESG ratings firms, make it possible for you to invest your money in companies that align with your personal values and principles.

ESG investment performance has been notable over the past decade

While ethical concerns might primarily drive you towards ESG options in your portfolio, the other pressing question mark is over how they perform in terms of returns.

In essence, the answer depends on the time frame you use to assess it.

Back in June 2020, investment provider Morningstar assessed the performance of nearly 5,000 funds over a period of 10 years in an attempt to work out whether sustainable choices could successfully compete with their traditional counterparts.

The headline of this research was that the majority of surviving sustainable funds (that is, those that survived over the 10-year period) outperformed their average surviving traditional peer.

In terms of annualised returns, sustainable options produced 6.9% across the 10-year period, while traditional funds lagged slightly behind with 6.3%.

However, in the past two years since Morningstar collated their initial figures, a lot has changed.

Data from investment platform AJ Bell alongside Morningstar and published in FTAdviser in April 2022 showed that ESG funds had fallen behind traditional equivalents over the last year.

Non-ESG global funds returned 8.7% in the year to 5 April, while ESG global funds posted returns of 6.6%.

For UK funds, this division was even more notable: non-ESG funds posted a 5.9% return, while UK funds managed just 2.2%.

This data is a great reminder that past performance doesn’t necessarily indicate future performance.

Greenwashing remains a prevalent issue in ESG investing

There’s another issue facing ESG investing aside from returns, and that is the pervasive problem of so-called “greenwashing”.

Greenwashing involves companies displaying good environmental, social, and governance credentials to gain access to funds and increase the funding they can receive, all while engaging in activities that investors might not consider ethical.

One particularly well-known example is that of online clothes retailer, boohoo. The company was regularly included in ethical funds for showing a strong commitment to social credentials in its workplaces and throughout its supply chain.

However, an investigation by the Sunday Times in 2020 alleged that boohoo was paying workers less than minimum wage in workplaces that were not safe – practices that are typically not considered to be particularly socially conscious.

Similarly, at the end of 2020, Citywire reported on how ESG fund managers were reviewing the inclusion of Kingspan, a company involved in the production of the insulation that led to the Grenfell disaster.

These two blackspots are sadly not an exception. The Financial Times reported in February 2022 that Morningstar had cut 1,200 funds from its “sustainable universe” over concerns that “ambiguous language” might mean the businesses were not as sustainable as they were supposed to be.

How to spot greenwashing

For you, the risk of greenwashing is that you end up putting your money in companies and funds that conflict with your values.

According to edie, the Financial Conduct Authority (FCA) has stated that it’s ready to start regulating ESG ratings firms to prevent greenwashing.

But in the meantime, it’s worth knowing a couple of ways in which you can identify issues yourself to avoid investing in companies that don’t align with your principles.

The first thing to do is to check the underlying investments in any ESG funds you intend to invest in.

Obviously, while you can’t know about the specific behaviours of every single company, you may notice inclusions of companies that you know have practices that conflict with your values.

Aside from reviewing the funds you’re interested in, you could consider selecting and investing in individual companies that support good ethical practices.

There’s plenty of information available online to help you decide whether certain companies meet your ethical standards, either in the product or service that they offer, or more widely.

By investing in individual companies rather than funds, you can ignore ESG ratings and simply invest in businesses that you have confidence in.

Bear in mind that this may be a more expensive way to invest. Additionally, it’s important to ensure that your portfolio is suitably diversified – a financial planner can help you to ensure this.

Take advice before you add ESG investments

Clearly, the issue of greenwashing highlights the importance of taking financial advice before you add a new type of investment to your portfolio.

By working with an expert, you can have confidence that your investments truly are as ethical as they purport to be.

Perhaps more importantly, taking advice before you invest in ESG assets is not just about avoiding greenwashing – there’s also the need for those investments to fit into your wider financial plan.

It’s certainly a noble aim to want the companies you invest in to have good environmental, social, and governance credentials.

But at the same time, you need to strike the balance between doing so and achieving your goals for the future.

Taking financial advice is arguably the best way for you to do both.

Get in touch

If you’d like to find out more about how ESG investments could help you, or you’d like help keeping greenwashing out of your portfolio, please get in touch with us today.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not solely rely on anything you have read in this article and ensure that you conduct your own research to ensure any actions you may take are suitable for your circumstances. All contents are based on our understanding of HMRC legislation, which is subject to change.