As a firm who specialise in advising clients with connections in both Australia and the UK, one of the most common subjects our clients ask us about is UK Inheritance Tax (IHT).

Many have emigrated to Australia but still have parents and other family in the UK. They are, therefore, rightly concerned at the potential impact of IHT when their UK-based parents die.

Understanding how IHT is calculated, and how it could impact on you personally, can help you plan your financial arrangements to reduce the amount payable by your family when you die.

So, in this article read about how IHT works and some potential issues you should be aware of, especially if you know that you’re likely to receive an inheritance in the future.

The importance of the nil-rate band

When it comes to thinking about IHT, the most important factor to consider is the nil-rate band (NRB), also known as the “IHT threshold”.

You will pay IHT at 40% on the value of an estate above the applicable nil-rate band. The current nil-rate band is £325,000 and the UK government has confirmed that it will stay at that figure until at least 2026.

On top of their nil-rate band, each person has the potential of a residence nil-rate band (RNRB), which is currently £175,000. This applies if you leave property to a direct lineal descendant.

It is also important to note that if someone is married or in a civil partnership, the total value of the estate on first death will automatically pass to the surviving partner with no IHT being payable. The value of their NRB and RNRB (if applicable) also pass to the surviving partner.

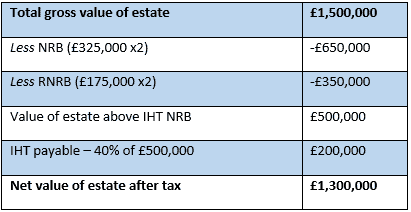

So, in this example, a widow has died four years after the death of her husband.

As you can see, the husband’s nil-rate band and nil-rate residence band were both used, which reduced the IHT liability by £500,000.

Note that where an estate is valued at more than £2 million, the RNRB will be ‘tapered away’, progressively reducing by £1 for every £2 that the value of the estate exceeds the threshold.

Intra-spouse or civil partner transfers for non-doms

We have referred above to the transfer of the value of the estate between a spouse or civil partner on first death.

This also applies if the surviving spouse or civil partner is not UK domiciled, although maximum allowance that can be transferred on death is capped at the nil-rate band of £325,000.

The non-domiciled survivor can elect to be treated as UK domiciled to receive the transfer free of IHT, but in that instance the total value of the worldwide estate will then subsequently be within the scope of the charge to IHT on the surviving spouse’s death.

Ways to reduce IHT payable on an estate

There are some simple ways for someone to reduce the potential IHT payable on their estate.

One of the most common is to gift assets. Everyone is entitled to make £3,000 worth of gifts per year plus unlimited sums of £250 to any number of individuals.

They can also make regular gifts out of surplus income, subject to certain requirements.

Beyond that, potentially exempt transfers (absolute gifts) are exempt if the individual survives for seven years after they make the gift. Within those seven years tapered rates of IHT apply, between three and seven years.

There are also more complex ways to reduce IHT, including gifting property, and various business-related reliefs. The key issue is to recognise that succession planning can be a complex subject, so it is always worth getting advice from a financial professional.

The importance of domicile

When it comes to assessing IHT liability, an individual’s domicile status is crucial. Note here that we are talking about the domicile status of the deceased.

As far as IHT is concerned, being non-UK-domiciled is a huge advantage. It means that for someone living in the UK, but who is non-domiciled, IHT only applies on their UK assets.

But when someone who is UK-domiciled dies, their entire worldwide estate is subject to IHT. The tax applies at 40% to assets both within and outside the UK.

So, someone UK-domiciled will be subject to IHT on the value of their assets in Australia. This is a really important point to note because it could have a massive impact.

IHT and property in Australia

Where the deceased is both UK-domiciled and a UK tax resident, and owns property in Australia, UK IHT will be payable at 40% (subject to the reliefs we outlined above).

It’s also possible that Capital Gains Tax (CGT) could apply on the sale of the property.

The amount of CGT is dependent on the terms of the will, and when the property was originally acquired.

Given the potential impact of both IHT and CGT, we would strongly recommend that you speak to a tax expert to get professional expert advice.

Advantages of being a non-domicile

Even if someone has been resident in the UK for a few years, you may still be non-UK domiciled. Under English law, they may have been UK resident for some time, and may even have acquired British nationality, and yet you may still have a domicile outside the UK.

So, in the above example, IHT would not be payable if the deceased were not UK-domiciled.

The same principles apply to gifts. As we have covered, a UK-domiciled person will potentially pay IHT on a gift they make if they die within seven years of making the gift. But if they are non-UK domiciled, there will be no IHT on such a gift, even if the gift is one which would potentially give rise to an immediate IHT charge for a UK-domiciled person.

Using “excluded property trusts” to reduce IHT

As mentioned above, someone will generally lose their favoured IHT status regarding Australian assets once they become UK domiciled. At this point their non-UK assets will fall within the scope of IHT.

One way to mitigate this tax is by using an “excluded property trust”.

Here, if someone is a “non-dom” and they gift non-UK assets, including property, to an excluded property settlement before they become “deemed domiciled”, these assets will remain outside the scope of UK IHT even after they subsequently become UK domiciled.

Additionally, these assets in the trust will remain outside UK IHT even beyond the death of the beneficiary, protecting these assets from IHT for future generations.

So, for example, if your parents currently live in the UK as non-doms, by setting up an excluded property trust on their Australian assets they can avoid these assets being liable for IHT if they subsequently become UK domiciled.

Currency exchange costs

A slightly less complex issue is that of currency exchange.

Whenever you inherit money from overseas, you may need to transfer it to your local bank account in Australia swiftly and securely.

Unfortunately, banks often charge margins of up to 5% above the daily exchange rate. So, on a transfer of $100,000, you could pay up to $5,000 to your bank.

It’s therefore advisable to use a currency exchange specialist when you’re looking to move money between countries, especially in circumstances where large sums of money could be involved.

When transferring any amount of money, you must always ensure that the currency firm is fully regulated by the appropriate authority and that your money is protected.

Get in touch

Inheritance Tax and domicile are complicated areas, and it is always advisable to take professional financial advice. Mistakes and oversights can prove very costly.

At bdhSterling we have licences in both the UK and Australia for full financial planning and so we can provide bespoke advice based on your specific circumstances.

Feel free to contact us for a no obligation chat. Get in touch if you believe you would benefit from advice.