This is the first in a series of articles designed to help international investors navigate key aspects of financial planning. These articles will give you some valuable insight into topics like inflation, diversification and timing the markets – all key issues for successful cross-border investing.

In future months, you will be able to find out about important topics such as the effect of inflation and the importance of a diversified portfolio.

To kick things off, now read all about market volatility and why not fearing it is one of the ways to achieve long-term investment success.

This article draws on data and insights from Dimensional Fund Advisors, a globally respected investment firm and one of our trusted fund management partners, whose strategies many of our clients invest in.

Using the weather to understand the difference between stock movements and volatility

Before you start reading, take a look at this short, fun video, which uses the example of weather to explain the difference between day-to-day market fluctuation and longer-term investment volatility.

Volatility is a natural feature of stock markets

Whether you’re investing in the UK or Australia, market fluctuations are inevitable and to be expected.

Markets are made up of the stocks and shares of different companies. Their performance will be affected by external factors, such as:

- Inflation driving up business costs

- The economic performance of different countries and regions

- Geopolitical concerns such as military conflicts or regional tensions.

Internal factors will also have a bearing on the value of shares. These will include:

- Business performance

- Specific issues affecting whole market sectors

- Competitor activity.

All these factors can create volatility in individual share prices. If you then transpose that over different markets and sectors, it’s easy to see how it can affect the value of your assets.

Here are two charts that drill down into the concept of volatility in more detail and help to explain why it is something to be welcomed rather than feared.

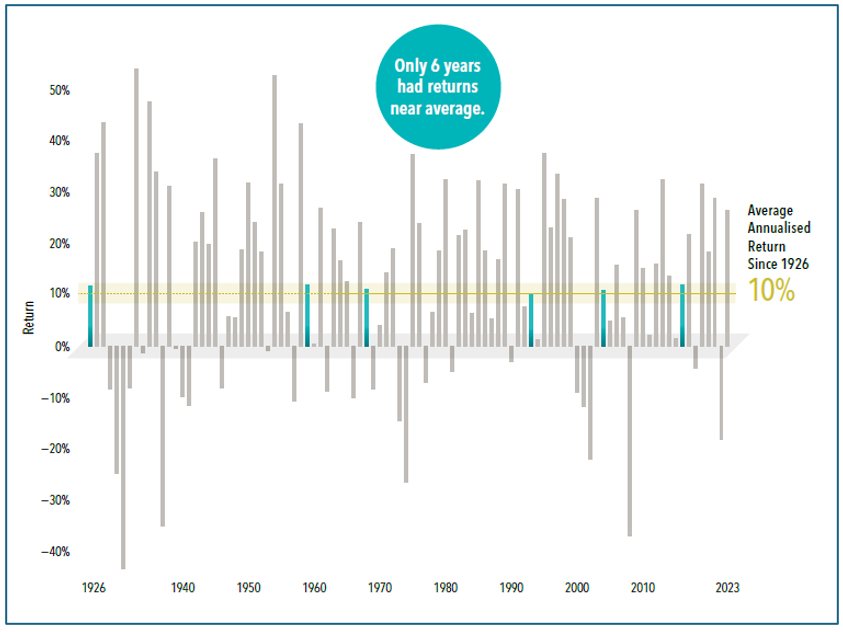

Chart 1 – US markets have averaged 10% returns over almost a century

Source: Dimensional

As you can see from the chart showing the total returns of the S&P 500 index from 1926 to 2023, annual performance has varied from as high as +54% to as low as -43%.

As you would expect, over such an extended period, there have been a series of different factors that have driven such diverse performance, from the Great Depression and the 1970s oil crisis, to the post-war boom and the rise of digital technology.

Interestingly, over that extended period, returns came within two percentage points of the market’s long-term average of 10% in only six of the past 98 years.

Despite this volatility, the market delivered positive returns in 72 of those years, compared to 26 negative years.

The key lesson to draw is that understanding the range of potential outcomes can help you stick with a plan and ride out the inevitable volatility.

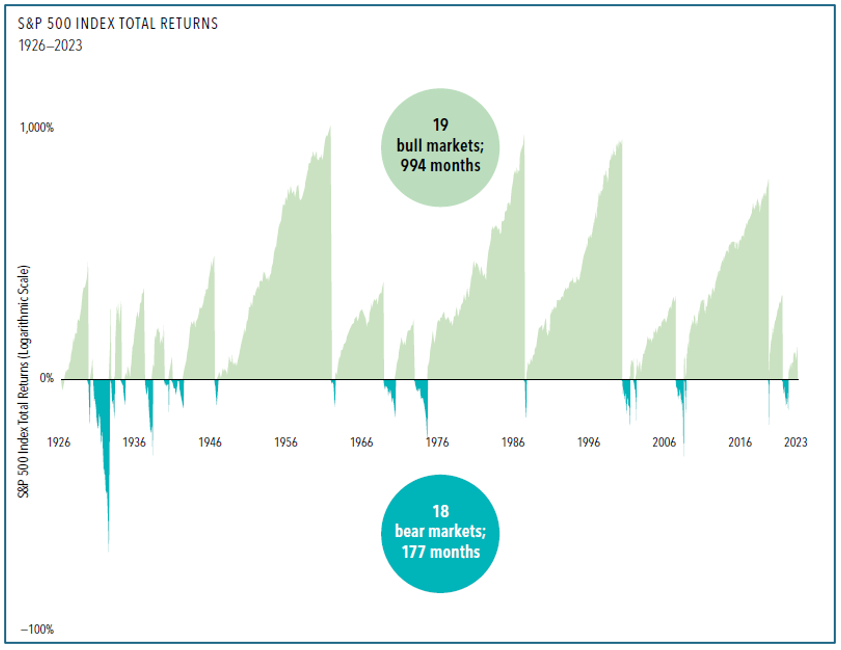

Chart 2 – Bull markets last far longer than bear markets

Source: Dimensional

Stock returns are volatile, but this chart demonstrates the fact that, through nearly a century of bull and bear markets, the good times have outshone the bad.

From 1926 to 2023, the S&P 500 index experienced 18 bear markets, defined as a fall of at least 20% from a previous peak. The losses ranged from 21% to 80% across an average length of 10 months.

On the upside, however, there were 19 bull markets, or gains of at least 20% from a previous trough. They averaged 52 months in length, and advances ranged from 21% to an astonishing 936%.

Viewed together, this pattern highlights a powerful truth: equities have rewarded disciplined, long-term investors.

The point to remember is that while stock market ups and downs are unpredictable, history supports a clear expectation of positive returns over time for those who stay the course.

You should not fear volatility

Volatility is part of investing. Markets will invariably go up and down. Furthermore, the fluctuation will often be dramatic and can result in apocalyptic media headlines – such as these from the Guardian, the BBC, and MSN – referencing “billions being wiped off the value of shares”.

However, as you have read about here, the market peaks are highly likely to outweigh the troughs over time.

For international investors, especially those managing assets across borders, maintaining a long-term perspective and refusing to panic will stand you in good stead, and help you grow your wealth.

Get in touch

Expert advice and regular reviews of your long-term investment strategy can help ensure that you are best positioned to achieve your long-term goals.

At bdhSterling, we specialise in helping clients navigate the complexities of international financial planning. Whether you’re managing assets in multiple countries or planning a move abroad, our expert advisors can help you build a resilient, long-term investment strategy.

If you would like to discuss your own investments, please get in touch with us today.

Please note

This article is for information only, it does not take into account your personal objectives, financial situation, or needs.

Please do not solely rely on anything you have read in this article and ensure that you conduct your own research to ensure any actions you may take are suitable for your circumstances.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

All contents are based on our understanding of HMRC and ATO legislation, which is subject to change.