One of the cornerstones of your future prosperity and wellbeing is the money you’re investing.

It’s likely that the bulk of this is in your super, building a fund to ensure you have the means to enjoy the retirement you’ve worked hard for throughout your working life.

Additionally, you may well have other savings that are invested, or a portfolio of stocks and shares.

A key component of your investment strategy is where and how you choose to invest.

Discover why investment diversification is key to your strategy and, as a result, to securing your financial future.

Diversification can help spread your risk

The best way to appreciate the importance of diversity is to consider the effect of not diversifying your investments.

If you were to put all your money into just a few investment funds or sectors you’d be totally dependent on the success of that limited number of funds to help grow your money.

Clearly there’s chance your choices could do well. But the nature of investment markets is that they fluctuate. So, to use a roulette reference, “putting all your money on red” is an extremely high-risk strategy.

Diversification doesn’t guarantee investment returns or eliminate the risk of loss including in a declining market, but it can help reduce your investment risk and give you a better chance of long-term growth.

Diversify across different asset classes

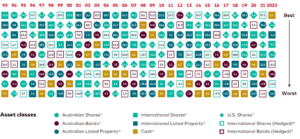

You can see the importance of investment diversity across different assets classes by taking a look at this chart.

It shows the comparative performance of various asset classes over a 30-year period.

Source: Vanguard Asset Management

You can see, in colourful detail, how different sectors have performed, and it demonstrates the danger of putting all your investment eggs in one sector basket.

For example, if you let your eye follow the journey of the green dots that signify Australian shares you’ll see year-on-year fluctuation with the ASX enjoying variable performance over the extended period.

This helpfully reinforces the messages that a wide, multi-asset spread of investments across sectors can be more beneficial in the long term than a more narrowly focussed portfolio.

When you’re investing in the long term, that sort of “not too hot, not too cold” level of return can stand you in better stead than the dramatic volatility of a single sector.

Consider the different asset classes in your portfolio

A well-diversified portfolio will combine several asset classes that carry different levels of risk.

The split should reflect your own investment aims, which will be driven by various factors, including:

- Your attitude to investment risk

- How much loss you’re prepared to accept in search of your goals

- The timescale over which your money is invested.

Timescale is particularly important. Your investment horizon should be in excess of five years, and the longer you can keep your money invested the better your chances of seeing good growth on your investments.

It’s also important to regularly review your investment choices to ensure your portfolio is still fit for purpose and on track to meet your goals.

How you split your assets among different categories is important to help you regularly balance your portfolio and reflect your changing circumstances.

Different asset classes tend to perform differently under similar market conditions. So, if you’re “overweight” in one particular sector, you could be disproportionately affected by a fall in value of a specific class.

The importance of diversifying your holdings within asset classes

Once you’ve diversified between different asset classes, the next key step is to ensure your money is further diversified between the different holdings in each particular sector.

For example, when it comes to individual company shares, the possibilities for diversification are vast.

You can diversify by the size of the companies, geographic location, or specific industry.

Your diversification strategy when it comes to specific holdings should be tailored to your personal financial goals and tolerance for risk.

Avoid the danger of home bias

As the name suggests, “home bias” describes the temptation many investors feel to invest in companies or geographic regions they are familiar with.

If you recognise well-known Australian companies as they are referenced in the financial press, it can be easy to simply focus on their individual shares rather than investing with more diversity.

The same applies with equity funds focussing only on Australian-based companies.

As different investment sectors go through cycles of good and bad performance, so does a nation’s economy. Too much over-reliance on your home country can leave you exposed in the event of the Australian economy suffering a recession and companies being affected by the downturn.

Get in touch

If you have any queries regarding your investment strategy, or financial planning more generally, then please do get in touch with us.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not solely rely on anything you have read in this article and ensure that you conduct your own research to ensure any actions you may take are suitable for your circumstances. All contents are based on our understanding of ATO and HMRC legislation, which is subject to change.