The eminent psychologist and behavioural scientist, Daniel Kahneman, passed away earlier this year.

Kahneman made his name studying cognitive biases, particularly those around money and financial management.

His research into the psychological side of money management in particular led to him being referred to as the “grandfather of behavioural economics”. And in 2002 he was awarded the Nobel prize in Economic Sciences for his work.

One key concept Kahneman developed is known as “loss aversion”, which is a cognitive bias that could influence your financial decisions making.

Read on to discover what loss aversion is, why it matters, and how you can prevent it from having a negative influence on your future wealth.

Losses are more impactful than gains

The central idea around loss aversion is that we feel the pain of losses twice as intensely as the pleasure of gains.

Because of this, we are often prepared to turn down the opportunity to gain, simply to avoid the potential pain of a loss.

The simple example psychologists use to illustrate this is to ask whether you would rather have a 100% chance of receiving £10, or a 50% chance of being given £100?

The concept of loss aversion means that, because it is guaranteed, we are more likely to accept the lower amount, even though you could receive a larger amount by taking on an element of risk.

By accepting the idea that the fear of losses gets stronger as the amount of money at stake increases, it is easy to see how loss aversion could affect your attitude towards investment decision-making in two important ways:

- You will be more likely to react to investment volatility

- You may be reluctant to let go of assets.

Unfortunately, loss aversion is common when it comes to managing your finances. A Money Marketing report confirmed that 55% of UK adults said they are more concerned about the possible losses than the potential gains from making an investment.

Loss aversion can distort decision-making

In reality, an element of loss aversion can result in a cautious attitude to your money that could serve you well. After all, it could mean you avoid highly speculative decisions that could result in the type of large-scale losses that could seriously harm your wealth.

However, over the long term, being susceptible to loss aversion could actually have far-reaching and potentially harmful consequences.

For example, the two most common methods of growing the value of your money are to save it in a standard investment-bearing account, or to invest it in shares, or an investment fund.

The most loss-averse approach is to save your money, comfortable in the knowledge that your wealth is safe from market fluctuations, and it won’t depreciate in value.

However, while investing your wealth does involve an element of risk, your potential for greater returns is typically higher.

Furthermore, investing has been proved to produce greater returns than cash in the long term, even when taking market volatility into account.

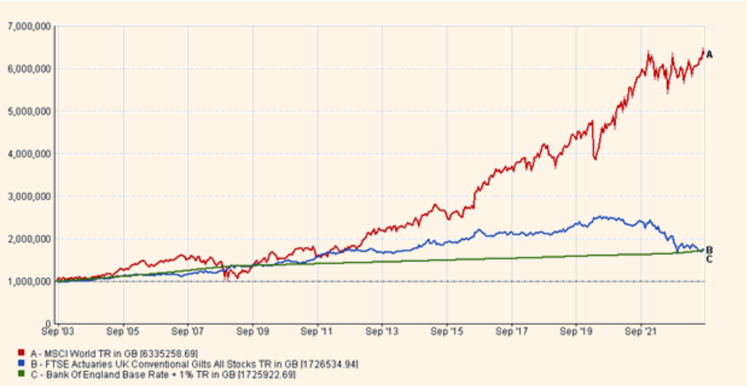

You can see that illustrated on this chart, which compares £1 million invested and saved over a 20-year period from August 2003.

The red line shows global stocks, (MSCI World), the blue line is the value of UK government bonds, and the green line is the Bank of England base rate plus 1% to denote a standard savings rate. The differences after 20 years are startling.

Source: Saltus

This demonstrates that investing is the more sensible move for building long-term wealth, but excessive loss aversion may result in lower returns.

3 steps you can take to avoid excessive loss aversion

Overcoming loss aversion may be necessary to ensure that you can make the most effective decisions with your wealth. An excessive fear of losing out could see you generate smaller returns on your wealth.

Fortunately, there are some simple steps you can take to help you manage your attitude towards investing money and prevent loss aversion from inhibiting your wealth accumulation.

1. Tuning out the noise

Loss aversion can be driven, in part, by bad news, and the promotion of negative market events.

The media are well-aware that bad news sells newspapers and promotes clicks on a website, which is why you see so many “billions wiped off the value of shares” type of headline. Good news – in terms of market recovery and growth – doesn’t carry the same attraction, spread as it is over an extended period.

2. Appreciating investing is a long-term process

If you are investing, we would recommend that you do so with a minimum time frame of five years. Anything less could result in markets not having enough time to overcome the effect of periods of short-term market volatility.

In reality, the longer your money stays invested the better. Ultimately, you should view your investment strategy as a marathon, not a sprint.

3. Understanding your attitude to risk

It’s a fact of life that some people are more comfortable with risk than others.

However, it is important to appreciate the different levels of risk attached to the range of investment choices on offer.

You should also understand that diversifying your investments across a range of different market sectors and regions could help to reduce the level of risk in your portfolio, without overly supressing the potential for long-term investment growth.

Working towards your desired retirement lifestyle

When you are planning your long-term financial future, it’s important to consider your personal goals and aspirations.

By doing this you can focus on what you need to achieve rather than seeking to generate the greatest returns possible.

This can help ensure that your level of investment risk is tailored to help you reach your long-term financial goals. As such, you may find it easier to accept short-term losses, safe in the knowledge that you have a long-term plan designed to provide you with the lifestyle in retirement you have worked hard for.

Get in touch

To find out more about loss aversion and how it could affect your long-term financial planning, please get in touch with us.

Please note

The value of your investments can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not solely rely on anything you have read in this article and ensure that you conduct your own research to ensure any actions you may take are suitable for your circumstances.