Universal healthcare was first introduced by the Whitlam government in 1975 when Medibank was launched. This was later expanded and renamed Medicare by the Hawke government in 1984. It’s now recognised as one of the best public systems in the world.

When most of us visit our General Practitioner, collect a prescription from a pharmacy, or receive specialist care, we don’t have to pay anything. This carries benefits for individuals and employers alike.

Individuals have the reassurance that, should they or a family member fall ill, treatment won’t result in a big financial bill at the end. Employers also benefit from a healthy and, therefore, more productive workforce, and aren’t obliged to implement the employer-sponsored schemes present elsewhere, such as in the United States.

The challenge of funding Medicare

As with all healthcare systems, funding Medicare since its inception has proved to be a challenge. The initial Medicare levy of 1% was insufficient as demand, improved treatment, and increased life expectancy have put pressure on the system.

By 2014 the levy had doubled to 2%, with the government picking up the slack through general expenditure.

First introduced in 1997, the Medicare Levy Surcharge (MLS) has the dual purpose of helping the government fund Medicare, while also encouraging those who can afford it to take up private health insurance and, therefore, relieve the burden on the public healthcare system.

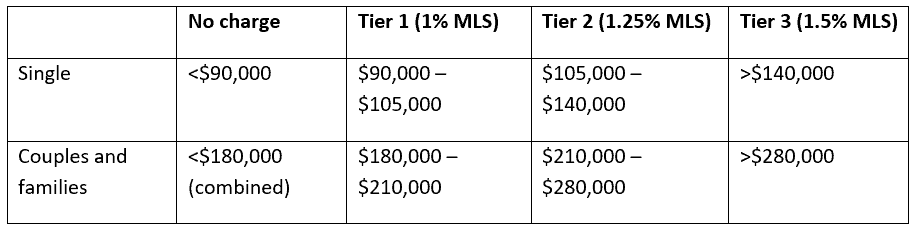

If you’re earning more than $90,000, or are in a couple with a combined income of more than $180,000, you are liable to pay the MLS if you don’t have a suitable level of private healthcare cover.

Depending on your income, the surcharge will be between 1% and 1.5%.

The surcharge is payable for each day you don’t have private health insurance within a financial year. That means if you don’t purchase a policy before the start of the new financial year on 1 July, but buy one later in the year, you’ll pay a charge for each day you weren’t covered.

How much is the Medicare Levy Surcharge?

As we have stated, the amount of MLS you’ll pay is dependent on how much you earn, either on your own if you’re single, or as a family.

The table below outlines the charging tiers, and the applicable levy for each.

For example, a couple earning $250,000 between them would pay an MLS of $3,125.

If you have two or more dependent children, the family threshold will increase by $1,500 for each dependent child after the first child.

How to avoid the Medical Levy Surcharge

The government originally designed the MLS to encourage high earners to take out private healthcare and therefore ease the burden on Medicare, making it more effective and accessible for low earners who cannot afford private care.

However, it’s more than just simply a case of signing up for a cheap private healthcare plan, which provides a minimal amount of cover, simply to avoid the MLS.

The two key criteria for a private health insurance policy eligible to avoid paying MLS are:

- It must include hospital cover

- The excess on your hospital cover needs to be $750 or less for single people, or $1,500 or less for couples, families, and single parents.

You will not have to pay MLS If your private health insurance meets these two criteria.

If you are subject to the Medicare Levy Surcharge, everyone in your family will need coverage for you to avoid paying the levy.

There is a third criteria to consider, which is whether the cost of the private healthcare is less than you’ll save by not paying MLS, although this is not necessarily such a clear-cut decision.

The benefits of private healthcare

Even if private healthcare costs more than you would save by avoiding the MLS, there are some good reasons why it may still be worth taking out.

Former UK prime minister, Margaret Thatcher, neatly summed up the benefits of private healthcare when talking at a press conference in 1987. She said private health insurance “enable[s] me to go into hospital on the day I want; at the time I want, and with a doctor I want.”

If you are busy running your own business, for example, that kind of flexibility can be especially important.

Additionally, the waiting list for elective surgery can often be shorter in the private sector, so treatment could be more quickly accessible than with Medicare.

Some private healthcare policies also offer access to ancillary and added-value benefits such as physiotherapy, dental, and optical care.

Obviously, your final decision will depend on the difference in the amount you’ll end up paying, and your own personal financial circumstances. However, it’s worth considering the decision from a wider perspective than just the final cost, if possible.

Get in touch

At bdhSterling, we have a wealth of experience in helping clients with all aspects of their financial planning.

Get in touch to find out how we can help you.