As you may well be aware from even a cursory look at the financial news, there is a big ongoing debate about Inheritance Tax (IHT) in the UK.

In this article, you can read a summary of the arguments deployed by the protagonists in that debate.

Then, you can discover four simple steps you could take to help reduce your IHT liability.

There are some strong arguments for the abolition of IHT

IHT is payable at 40% on the value of your estate that exceeds the current tax-free thresholds.

The basic IHT threshold, known as your “nil-rate band”, is currently £325,000 in 2023/24, and has been frozen at that amount since April 2009. UK chancellor Jeremy Hunt confirmed in this year’s spring Budget that the threshold will stay at that level until April 2028, too.

In addition to that, you have a residential nil-rate band of £175,000, subject to you leaving your main residential property to your direct descendants, such as your children or grandchildren.

Rising inflation and property values mean that more estates are exceeding the nil-rate bands and, as a result, are becoming liable for IHT. Indeed, according to Statista, the amount of IHT paid to HMRC in the 2022/23 year was nearly £7.1 billion – a £1 billion increase on the previous year.

As residential property is a fairly illiquid asset, your beneficiaries may need to sell your family home on your death to be able to pay the IHT due.

Those opposed to IHT argue that it is a levy on assets that have already been taxed, so why should people have to pay again? They then say that you should be free to pass on assets to your children, or other beneficiaries, without the government taking a share.

A recent article in the Times suggested that the government may be thinking of including the abolition of IHT in their manifesto at the next election – due before January 2025.

There are equally good arguments in favour of retention

Those in favour of IHT say it’s a good way to redistribute wealth, taking it from estates with substantial assets and spending it on key services such as health and education.

Furthermore, IHT is a tax on capital, rather than income. As a result, it does not have the same effect on families and individuals that other UK taxes such as Income Tax and VAT can have.

They also point out that it affects a relatively small percentage of people. Indeed, according to FTAdviser, more than 93% of estates are not expected to incur an IHT liability in the coming years.

In the current economic climate, the Institute for Fiscal Studies point out that abolishing IHT to protect the assets of a small and relatively wealthy percentage of the population would potentially send a very negative message about any commitment to social mobility.

With each individual entitled to both nil-rate bands, as a couple you can still pass on up to £1 million to your beneficiaries free from IHT.

4 simple steps to mitigate your liability

Regardless of the ongoing debate, the reality is that IHT is currently chargeable. So, it is important for you to have effective estate planning measures in place to mitigate any potential liability.

It is relatively easy to take some straightforward measures to help reduce the amount of IHT payable by your beneficiaries after your death – or even eliminate it entirely.

1. Make the most of your gifting exemptions

You can reduce the size of your estate and IHT liability by gifting assets. You may give away up to £3,000 each tax year without incurring IHT. This is known as your “annual exemption”. Every individual, regardless of earnings, enjoys the same exemption.

There are additional gifting allowances available for weddings and civil partnerships.

It is also possible to make other gifts up to £250 to individuals each tax year, if the recipients have not also benefited from the £3,000 annual exemption or any other tax-free gifts.

Charitable gifts are also exempt from IHT, as are donations to registered political parties.

2. Make larger gifts, but be aware of the “seven-year rule”

You can, of course, choose to make unlimited gifts to individuals. These are known as “potentially exempt transfers” (PETs).

The key point to be aware of, however, is that if you pass away within three years of having made the gift and it is not covered under one of your other exemptions, the full rate of IHT is payable on the value of your estate above the nil-rate band.

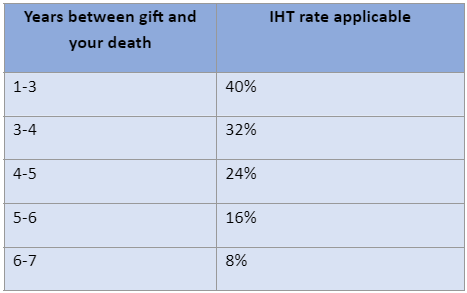

The amount of tax due then tapers down between years three and seven – hence the “seven-year rule”.

3. Reduce your IHT liability by using trusts

By putting assets in trust, you are effectively ceding control of them and passing them to a trustee in the first instance, and then ultimately the beneficiary stated in the trust deed.

As a result, those assets are deemed to be outside the value of your estate for IHT purposes.

It’s important to note, however, that assets in trust are not entirely free from UK taxation, either while they remain in trust or after they have been paid out.

As a result, we would recommend that you take advice from a tax expert before looking to put any of your assets in trust.

4. Set up a life insurance policy in trust to cover your liability

A common way to help your beneficiaries deal with any IHT payable on the value of your estate is to set up a simple life insurance plan to cover any expected liability.

One key point to note, however, is that you need to put such a policy in trust and instruct that funds from a claim should be paid to your intended beneficiaries.

If you don’t do this, you may well just be adding to the overall value of your estate. The proceeds of the life insurance policy could be taxed at 40%, accentuating a problem it was meant to alleviate.

Get in touch

We have a wealth of experience in helping our clients with their estate planning issues.

If you would like to talk through your own circumstances, please get in touch with us.

Please note

The value of your investments can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not solely rely on anything you have read in this article and ensure that you conduct your own research to ensure any actions you may take are suitable for your circumstances. All contents are based on our understanding of HMRC and ATO legislation, which is subject to change.