Last month we sent out a special newsletter providing an instant outline for you of the Australian 2024 Federal Budget and some of the key announcements that were made.

As this was written and sent in the immediate aftermath of the Budget, it was just a very quick overview to make you aware of some of the key changes.

Now that the dust has settled, and we have had a chance to carefully review the 2024/25 Budget statement. Read our more detailed analysis of the key points and how they could affect your personal finances.

The announced Income Tax cuts could affect your take-home pay

Clearly, the most important takeaway from this year’s Budget were the major changes to the amount of Income Tax you pay.

The headline changes are:

- If you earn between $18,201 and $45,000 a year you will see your 19% marginal tax rate reduced to 16%

- The 32.5% rate has been cut to 30% and the bracket expanded from $120,000 to $135,000

- The 37% tax bracket, which was previously due to be abolished, has been retained

- The threshold at which you start paying the 45% top tax rate has been reduced from $200,000 to $190,000.

The table compares the current rates with those that will apply from 1 July 2024. The figures in bold highlight the changes that will be applicable. Note that these figures do not include the Medicare levy of 2%.

Source: Australian Tax Office

What the tax changes could mean for you

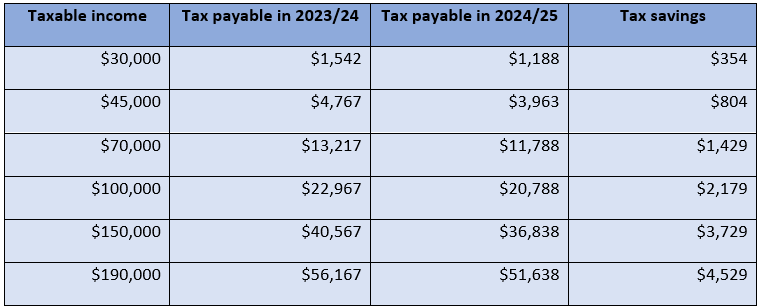

The table below shows the comparative levels of tax you will pay based on your earnings.

Source: Etax

You should note that these changes don’t come into effect until the 2024/25 financial year so your 2023/24 tax return will not be affected by these new tax cuts.

Your tax return covers the income year from 1 July to 30 June. If you need to complete a tax return you must lodge it or engage with a tax agent, by 31 October.

However, the changes are likely to increase your monthly take-home pay from next month.

The primary aim of the tax cuts is to help relieve cost of living pressures by providing more disposable income for you each month. It is also hoped that the tax cut will help drive economic growth by increasing consumer spending.

Once you have ascertained how the changes will affect you, you might want to consider earmarking any extra monthly income for a specific financial planning-related purpose, such as boosting your regular savings or reducing debt.

Superannuation on paid parental leave

The headline announcement in the Budget affecting superannuation concerned paid parental leave.

To address the wide disparity in retirement income between men and women – now at 25% – from 1 July 2025, eligible parents will receive an additional payment based on the Superannuation Guarantee as a contribution to their super during periods they are taking parental leave.

The intention behind this proposal is that it will help normalise parental leave as a workplace entitlement like annual leave and sick leave.

Don’t forget the super changes from 1 July 2024

While they were not Budget announcements from this year, it is worth remembering four changes to super that have previously been confirmed, and that are due to come into effect from 1 July 2024.

- The compulsory Super Guarantee (SG) rate will increase from 11% to 11.5%. This is part of the ongoing process to gradually increase the SG rate to 12% via incremental increases each financial year.

- Additionally, the maximum super contributions base will increase from $62,270 to $65,070 each quarter.

- The concessional contributions cap is set to increase from $27,500 to $30,000.

- Finally, the non-concessional contributions cap is set to increase from the current $110,000 per year or $330,000 by triggering the bring-forward provisions, to $120,000 per year and $360,000 with bring-forward.

Subject to your status and eligibility, all four of these measures could result in increased contributions going into your super fund as well as being more beneficial with the non-concessional limits helping the transfer of larger amount of UK pension funds across to Australia.

A new Capital Gains Tax regime for foreign residents

One key change announced could well affect you if you are a foreign resident in Australia.

In a move designed to align the tax treatment of foreign and Australian residents, foreign residents will now be subject to a more stringent Capital Gains Tax (CGT) regime than was previously the case.

The new regime will apply to CGT events after 1 July 2025 and is intended to clarify the assets, such as property and shares, that CGT will be payable on.

From that date, the changes will:

- Clarify and broaden the types of assets that CGT is chargeable on

- Amend the point-in-time principal asset test to a 365-day testing period

- Require foreign residents disposing of shares and other major assets exceeding $20 million in value to notify the ATO, prior to the transaction being executed.

However, it’s worth noting that the Government will be carrying out a consultation exercise with regard to the details of this measure, so it’s possible that these proposed changes will be amended prior to coming into force next year.

Changes to deeming rates on social security

Another key measure announced in the Budget was an extension to the freeze on social security deeming rates for a further 12 months to July 2025.

Deeming rates are used to determine how much income you are deemed to earn from your assets, such as savings and investments.

The deeming rates were frozen at 0.25% and 2.25% during the pandemic and subsequent cost of living challenges to help pensioners and recipients who rely on income from financial investments.

Aged care changes if you have elderly parents or other relatives

In his Budget report, the Treasurer also confirmed that the Government will defer the commencement of the new Aged Care Act to 1 July 2025.

It will also provide funding over five years from this year to deliver a range of key aged care reforms and to continue to implement the recommendations from the Royal Commission into Aged Care Quality and Safety.

The recommendations are proposed to include:

- The release of 24,100 additional home care packages in the coming tax year

- The implementation of a new aged care regulatory framework from 1 July 2025

These measures could be particularly important to you if you have elderly parents, or other relatives, who are currently receiving care, or may well require future care provision.

3 anticipated announcements did not materialise

As you will appreciate, we always keep a close eye on the Budget details to look for any changes that, while not headline announcements, could have an effect on your long-term financial planning arrangements.

There were three important retirement planning issues that we were expecting to be addressed, but were not:

- New measures relating to additional taxation on your super fund if your balance is in excess of $3 million.

- An update on the time frame for legacy pension conversions or self-managed superannuation fund (SMSF) residency changes

- The age from which you can generally access your super to become 60 for all Australians.

Given the silence on these points, we think it’s safe to proceed based on previous announcements made.

Get in touch

If you have any queries regarding anything you have read in this article about the Budget changes, please get in touch with us.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not solely rely on anything you have read in this article and ensure that you conduct your own research to ensure any actions you may take are suitable for your circumstances. All contents are based on our understanding of ATO legislation, which is subject to change.