One impact of the Covid-19 pandemic has been how it has negatively affected the value of shares and other assets because of the reduction in economic activity.

This has resulted in many retirees losing a significant portion of their super account balance as share markets have plunged due to the coronavirus crisis.

The Australian stock market index (ASX) fell by 32% at the start of the pandemic and it took markets until May 2021 to recover to the pre-pandemic peak.

As a reaction to the initial fall, the federal government announced that the minimum super drawdown rates would be temporarily halved for the 2019/20 and 2020/21 financial years.

They have now stated that the temporary reduction will continue until the end of the 2021/22 tax year.

The temporary minimum withdrawal rates

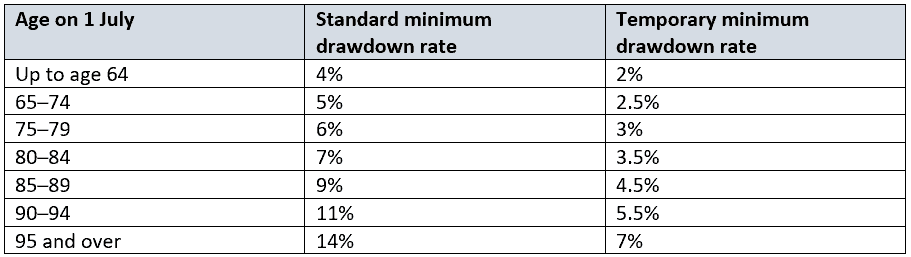

Minimum withdrawals are based on your age at the date of withdrawal.

This table shows both the standard withdrawal rates and temporary minimums.

Source: Australiasuper.com

The temporary reduction in pension drawdown rates applies to account-based pensions and similar products, including “transition to retirement” pensions.

You should note that the reduction does not apply to defined-benefit pensions such as lifetime or life-expectancy products.

There have been previous withdrawal rate reductions

This is not the first time the government has reduced the minimum withdrawal amount to help super fund holders protect their investments by adding flexibility to their income withdrawals.

Retirees have been calling for this and citing the precedent of 2008 in the wake of the financial crash when rates were halved. Those rates remained in force until the end of the 2010/2011 tax year. In the two subsequent tax years after that, the rates were reduced by a quarter.

How you could benefit from the reduction

The big benefit from this reduction is that, if you’re currently drawing funds from your super, you won’t be forced to cash in assets at a time when values are low due to the Covid pandemic.

You will be able to leave more of your super untouched and subject to investment growth as markets improve.

Expectations are that the ongoing lockdown measures and restrictions on travel will cause a further recession. Super holders can leave more of their money invested ready to benefit from any post-recession recovery.

For example, a 66-year-old retiree with a super fund of $500,000 would normally have to draw down 5% of that figure – $25,000 – from their account. However, the reduced rates mean that they will only have to draw down $12,500 and can leave the remaining $12,500 invested.

Obviously, if you need to withdraw more than the minimum amount to meet your income needs you’re still able to do this.

Get in touch

At bdhSterling, we have a wealth of experience in helping clients with their retirement income planning.

Get in touch to find out how we can help you.