A big increase in Australian wage growth means that from 1 July 2024, you’ll be able to contribute more to your super fund.

The increase in both pre- and post-tax contribution limits will provide you with increased opportunities to boost your retirement fund.

Read on to discover more about the changes, and how you could benefit from them.

2 big changes have been announced

Increases to super contribution limits are based on salary indexation rates.

The higher-than-usual rate of inflation has driven increases in the Average Weekly Ordinary Time Earnings (AWOTE) index, which means that the limits are going up for the first time in three years.

The two most important changes are:

- The annual cap on tax-deductible concessional super contributions will increase from AUD $27,500 to $30,000.

- The non-concessional (post-tax) annual cap is increasing from AUD $110,000 to $120,000, which is four times the concessional cap.

Both of these new limits will be applicable from the start of the 2024/25 tax year (commencing 1 July 2024).

The “bring-forward” provision can help you quickly boost your super fund

Non-concessional contributions allow you to boost the value of your fund by making one-off payments into your super, in addition to your regular concessional payments.

This means that you can add more to your fund – maybe from savings or an inheritance – without paying extra tax.

Bring-forward contributions allow you to use your non-concessional contribution limits from future years within a shorter timeframe.

The new increased amounts mean that you can potentially contribute a lump sum of up to $360,000 to enhance your super fund.

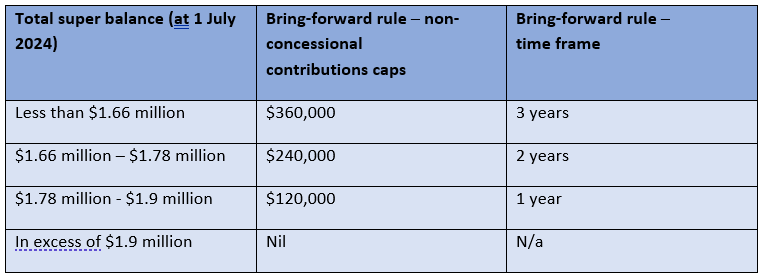

However, you should be aware that your maximum bring forward contribution is limited by your Total Super Balance, as set out in the table below:

Transferring your UK pension to an Australian super

The increases in contribution limits also provide you with added flexibility if you are looking to transfer your UK pension to a super fund as a Qualifying Recognised Overseas Pension Scheme (QROPS).

Transfers from any external fund into a super fund are limited by the non-concessional cap each year, but these changes now mean that – subject to your eligibility – from 1 July 2024, you can transfer $360,000 initially into your fund.

You can then wait for your cap to reset. Once you have used the bring-forward facility you will need to wait two or three years before you can contribute again.

As a result, this will help escalate the rate at which move your money into your super fund.

You can also find out more about transferring your UK pension in our guide to this subject.

Get in touch

If you have any queries regarding your financial planning, please get in touch with us.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not solely rely on anything you have read in this article and ensure that you conduct your own research to ensure any actions you may take are suitable for your circumstances. All contents are based on our understanding of ATO legislation, which is subject to change.