In the midst of worrying economic news and a cost of living crisis, it’s perfectly understandable if you’re reviewing your regular outgoings and seeing where you can cut or reduce your spending.

Part of this review process may well have included considering reducing the amount you save regularly into your pension. In extreme circumstances, you may even have thought about stopping pension contributions totally.

Even if you’re only planning to do this for a short period, it could be a costly error in the long run. Read on to find out why, and how you should consider managing your pension during the current crisis.

Research has highlighted the problem of “lost” pension contributions

The effect of the cost of living crisis could mean £2.5 billion of “lost” pension contributions. This is the startling figure revealed in the latest ‘Retirement Report’ published by Scottish Widows, and reported in Money Age recently.

The report also revealed that:

- 11% of UK adults have already cut back or stopped their pension contributions

- If the average reduction of £47 each month is maintained for a year, it could result in more than double that amount being lost at retirement

- The cost of not raising contributions again after the current crisis ends could mean “lost” contributions of £7,000.

People are genuinely concerned about making ends meet

Given the scale of the current crisis, and the sense that things are likely to get worse before they start getting better, it’s understandable that there is widespread concern among people about how they will make ends meet.

The report found that 4 in 5 people are worried about their finances, and 76% are considering taking action to cope with the current, and anticipated, financial pressures.

The report also reveals that 57% have very specific concerns about their retirement finances, and half do not feel they are preparing adequately for retirement.

With retirement planning a genuine concern, what steps can you take to help yourself weather the crisis and try to ensure that your plans for a comfortable retirement are not jeopardised?

Make sure your contributions are working hard for you

One key step you should take is to ensure that you’re getting the most from your pension fund.

Rising inflation has the immediate effect of reducing the purchasing power of your cash savings. For example, the July 2022 CPI inflation rate of 10.1% means that goods costing £100 a year ago will now cost £110.10.

As well as the impact on your day-to-day finances, rising inflation also makes it imperative to ensure your pension savings are effectively invested. The research you’ve read about also found that nearly 1 in 5 savers have their accrued pension savings invested in cash and low-risk assets.

The highest inflation rate for more than 30 years means you should think carefully about where you’re investing your pension fund.

Consider a higher-risk investment strategy

One way to help maximise your opportunity for investment growth is to follow a higher-risk investment strategy.

Clearly, higher-risk investments will involve a greater chance of loss than safer alternatives. However, at the same time, you need to balance that potential outcome with an enhanced potential of greater, long-term gains.

Most pension investment is for the long term, and a longer time frame means you have more time for inevitable market fluctuations to work themselves out.

Ensure you reinvest dividends

A second key factor when it comes to giving your pension fund every chance of long-term, healthy growth is the reinvestment of dividends.

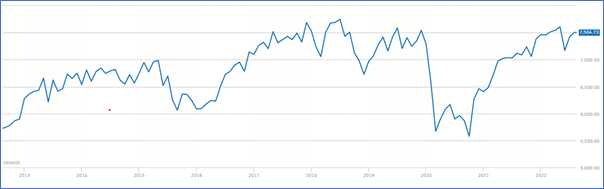

The chart below shows the performance of the FTSE 100 between August 2012 and August 2022.

Source: London Stock Exchange

As you can see, it’s been a roller-coaster ride over that 10-year period. Yet, according to Trustnet, the FTSE 100 produced annualised growth of 6.5% during that time. This is primarily driven by the reinvestment of all declared dividends, to purchase further shares.

Compared to that return to the best interest rate you’ll currently get on a cash savings account which, as of 16 August 2022 according to Moneyfacts, is 3.5%.

Remember how tax-efficient pension saving is

Clearly, in these difficult times, that there are no easy financial solutions. The cost of living crisis is affecting nearly all households to a certain extent, so it’s understandable if you’re having to make tough choices.

However, you should think twice before making decisions that could result in long-term pain for a short-term gain.

The compounding effect of dividends and a higher-risk investment strategy can both help boost the value of your pension fund.

Additionally, it’s always worth bearing in mind how tax incentives make pension contributions one of the most effective ways to save for your long-term future.

You automatically get basic-rate tax relief on all your contributions, so for every £80 you contribute, the government add £20 – that’s a 25% increase on the value of your money on day one.

If you’re a higher- or additional-rate taxpayer you can claim higher rates of relief through your annual self-assessment tax return.

Get in touch

We have a wealth of experience when it comes to helping our clients manage their pension funds. If you’d like to find out more, please get in touch with us.

Please note

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not solely rely on anything you have read in this article and ensure that you conduct your own research to ensure any actions you may take are suitable for your circumstances.

All contents are based on our understanding of HMRC legislation, which is subject to change.