According to This is Money, It’s been estimated that the average person in the UK now has 11 jobs during their working life.

Unlike previous generations, these days it’s rare for someone to spend their entire career with a single employer. People are now far more prepared to work for a series of different organisations during the 35 or more years they spend working.

One knock-on effect of this is that, if you’ve had a series of different jobs, you could potentially have an equal number of pension arrangements. These could be in employer-sponsored workplace schemes, or private arrangements you’ve set up yourself.

Such plans could be difficult to keep track of, especially if you’ve changed address, and scheme administrators no longer have your contact details. Additionally, pension providers often merge, change their name or are subject to takeover, making the task even more difficult.

One solution could be to consolidate all your pensions into a single arrangement.

Read about how consolidation works, and some of the pros and cons of doing so.

The first step is to work out what pensions you’ve got

Before you decide whether to consolidate your pensions into one plan, you should compile a schedule of your arrangements and obtain full details of them all, together with up-to-date valuations.

If you’re unsure of any details, the government have set up a Pension Tracing Service to help you find details of any plans you’ve lost track of.

Having all this information available will help you when you’re deciding whether to consolidate your plans. Even if you ultimately decide not to go ahead, you’ll have a clear idea of exactly what you’ve got. This will help with your retirement planning process.

Advantages of pension consolidation

Consolidation could save you money

By combining all your pensions into a single arrangement, you may be able to save on fees and investment management charges.

Remember, you’ll still be incurring charges on plans that you’re no longer paying into.

Reducing ongoing charges – even by just 1% each year – could make a significant difference to the long-term value of your pension.

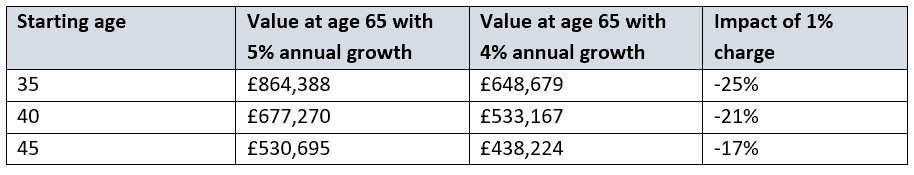

The table shows the difference a 1% reduction in annual return – equivalent to a typical charge – can make on a pension fund value of £200,000.

Source: Thecalculatorsite.com. The figures quoted are gross and do not take into account fees and charges.

Consolidation gives you a single view of all your pensions.

Consolidating all your pensions into a single arrangement gives you a single view of all your pension assets invested with a single provider.

It’s clearly easier to monitor a single plan with a value of £250,000 than 10 separate plans, each totalling £25,000.

It means you’ll be able to check how much your pension is worth from one single source, rather than have to laboriously check a series of different websites – all of which will probably require online log-in.

Having a single plan rather than a series of arrangements can also help simplify the transfer process if, at some time in the future, you want to transfer your pension to an Australian superannuation fund.

Consolidation makes it easier to plan ahead

Having one pension arrangements can also make it much easier to plan ahead.

If you know exactly how much you have in your pension, it’s easy to work out how much you need to invest going forward to create a fund to match your needs in retirement.

Then, when you reach retirement, all your pension income will come from a single source. So, you’ll be able to see the value of your pension at the click of a mouse whenever you want.

Consolidation can help you manage your tax affairs

A single plan can help you manage your tax affairs more efficiently, especially if you’re a higher- or additional-rate taxpayer and need to provide contribution details to HMRC each year to claim higher- or additional-rate tax relief.

Disadvantages of pension consolidation

There are three key reasons why consolidating all your pensions into a single plan may not be the best option for you.

You could incur charges to consolidate

If you do decide consolidation is the route for you, it’s possible that the transferring scheme will impose a charge for moving your pension fund to another provider.

Charges will vary, but they could have a big impact on the value of your pension fund.

So, it’s worth making sure you take any potential charge into account when you’re deciding whether to transfer.

You may lose access to guaranteed benefits

Some pension schemes offer a guaranteed annuity rate (GAR), which may provide you with a much higher annual income than you would otherwise get from a standard annuity. So, transferring out of such a scheme may mean you lose this valuable benefit.

You could miss out on investment growth

It’s possible that any existing pension funds that you’re considering transferring out of are invested in strong performing funds, which could produce good investment growth in the future.

Choosing the correct investment strategy is crucial when it comes to building a fund on the value of your pension.

Get in touch

Pension consolidation isn’t a straightforward decision, and we would always recommend you get financial advice before you decide what to do.

Get in touch to find out how we can help you.