Now that the dust has settled, and everyone has had a chance to properly review the 2023/24 Australian Budget statement, read a summary of the key takeaways and how they could affect your personal finances.

Inflation still remains a threat to your finances

With the Sydney Morning Herald reporting inflation reaching 6.8% at the beginning of June, it’s likely that rising prices are still having an effect on your finances.

A lot of the specific measures the Treasurer announced in his Budget statement to address the issue of rising prices were targeted at low earners.

This included a total of $14.6 billion “targeted relief” in the form of energy costs and support for anyone renting their property.

Soon after the Budget measures were revealed, the Reserve Bank Governor, Philip Lowe, reiterated the bank’s determination to ensure inflation returns to its target range of 2% to 3%. He anticipated that, on a current trajectory, this target will be hit by mid-2025.

This determination could result in the RBA increasing the cost of borrowing if they feel such a measure could help bring inflation down.

Read more: 5 useful ideas to help you deal with high inflation and rising interest rates

There will be substantial Income Tax cuts from July 2024

One very welcome bit of good news from the Treasurer was confirmation that the previously planned tranche of tax cuts will come into effect in July 2024.

These will result in:

- The removal of the 37% marginal rate tax threshold completely

- A reduction of the 32.5% marginal tax rate to 30%

- An increase in the threshold for the 45% marginal tax rate from $180,000 to $200,000.

With the changes indicated in the tables below, this will have the effect of streamlining the Income Tax rate bands.

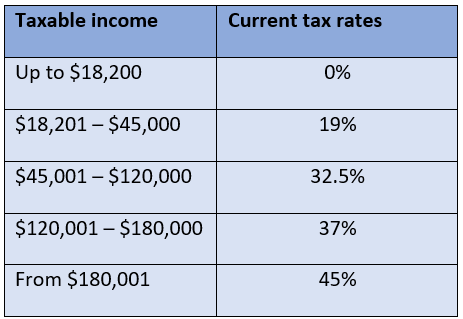

Table 1 – current rates of Income Tax

The above rates do not include the Medicare levy of 2%.

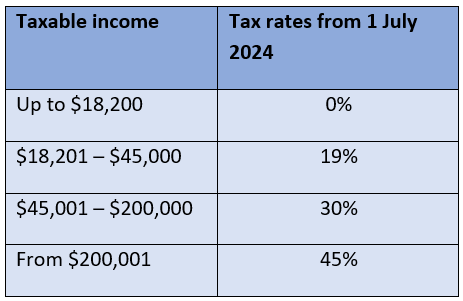

Table 2 – rates of Income Tax from July 2024

The above rates do not include the Medicare levy of 2%.

As you can see, if you have a taxable income above $45,000 you will benefit from these changes.

Based on figures from the Financial Review if you earn $60,000 you should pay $375 less in tax from 2024/25, while if you earn $120,000 you can expect a $1,875 reduction in your annual tax bill.

At the top end of the income scale, if you earn in excess of $200,000 you will receive a $9,075 tax cut.

Keeping more of your income each month should help relieve some of the pressure on your finances caused by high inflation. It may also potentially free up some money for investment or additional super contributions.

You’ll pay more tax if your super fund is worth more than $3 million

In his Budget statement the Treasurer announced plans to reduce the tax concessions on investment earnings for individuals with substantial total superannuation balances (TSB).

This means that a tax rate of 30% will be applied to future earnings if your TSB exceeds $3 million from 2025/26.

If you have a TSB less than $3 million you will not be affected by this change, and investment earnings on your accumulation balance will continue to be taxed at the maximum rate of 15%.

Your employer super contributions will be paid monthly

The Australian Tax Office (ATO) have previously estimated that $3.4 billion of super contributions went unpaid in the 2019/20 financial year.

Responding to this shortfall, the Treasurer confirmed that, from 1 July 2026, employers will be required to pay super contributions at the same time as their salary and wages.

This measure will help ensure that you get paid the superannuation you are owed. Furthermore, you should also benefit from funds being in your super account and being invested more quickly.

You could benefit from an energy incentive if you own a business

If you own a small business with an annual turnover of less than $50 million you could receive an additional 20% deduction on spending that supports electrification and more efficient use of energy, such as new heating and cooling systems.

You will be able to earmark as much as $100,000 towards this incentive, meaning you could benefit from a tax deduction of up to $20,000.

To qualify for this, you will need to ensure that the applicable upgrades are installed and ready to be used in the 2023/24 tax year.

As a business owner, you can write-off up to $20,000 on each new asset

The instant asset write-off threshold will be temporarily increased to $20,000 from 1 July 2023 for a year.

This means that if your annual business turnover is less than $10 million you will be able to instantly deduct the entire cost of certain assets that cost less than $20,000.

As with the energy incentive, you will need to ensure such assets are first used between 1 July 2023 and 30 June 2024.

You should note that the $20,000 threshold applies to each asset, so you could take advantage of this measure to buy multiple assets and benefit accordingly.

Get in touch

If you have any queries regarding the recent Budget statement, please get in touch with us.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not solely rely on anything you have read in this article and ensure that you conduct your own research to ensure any actions you may take are suitable for your circumstances. All contents are based on our understanding of ATO and HMRC legislation, which is subject to change.