In the UK, according to Statista, £7.09 billion Inheritance Tax (IHT) was paid to HMRC in the 2022/23 tax year.

Furthermore, this figure is set to increase in the current tax year, with an FTAdviser report confirming that the Office for Budget Responsibility (OBR) predicts that IHT will raise £7.2 billion in 2023/24.

This increase, and the record figures for IHT receipts, are primarily down to a combination of the recent rises in asset values and the government’s decision to maintain the IHT nil-rate band thresholds at their 2009 levels up to and including 2027/28.

One of the most effective ways to help minimise the amount of IHT payable on the value of your estate when you pass away is by gifting assets while you are still alive.

However, the whole issue of gifting can be complicated and there are some pitfalls that you need to be aware of.

So, we thought it was worth devoting an article to the subject, setting out some of the key points around gifting your assets to reduce your IHT liability – or even eliminate it entirely.

Inheritance Tax is only chargeable on the value of your assets above the nil-rate bands

IHT is charged at 40% and is paid on the value of your assets in excess of £325,000.

This is known as your “nil-rate band”. You also have an additional “residence nil-rate band” of £175,000 on the value of your main residence if you leave it to children or grandchildren.

So, this means that only estates in excess of £500,000 are liable to pay IHT, and as married couples can share that allowance the tax-free amount that the last surviving person can leave to their children is effectively doubled to £1 million.

There will be IHT liability on the value of assets you leave behind above that amount.

Gifting assets is an effective way to reduce your IHT liability

In recent years, more people are considering making gifts from their assets while they are still alive. There are many reasons for doing so, from reducing a potential IHT bill to helping support your children and grandchildren with key financial challenges they may face such as getting a foot on the housing ladder.

For example, the Great British Retirement Survey 2023 found that a tenth of Brits aged 40 and over said they’d made a substantial gift of this kind in the last three years, and a further 16% expect to gift money during the next three years.

Not only can this reduce your potential IHT liability, but you also get the pleasure of seeing your gift put to good use while you’re there to enjoy it.

You can gift assets to reduce your IHT liability

You have a £3,000 annual gifting exemption and any gifts up to that amount automatically fall outside of your estate for IHT purposes. This means that, as a couple, you could gift up to £6,000 a year between you.

You can also use your gifting exemption from the previous tax year, if you have not already done so.

Other gifts that you could make include:

- An unlimited number of gifts to different individuals up to the value of £250 each

- A gift up to £5,000 to your children, £2,500 to your grandchildren, and £1,000 to anyone else who is getting married.

A further, often overlooked, way you can gift is out of your regular income. Gifts made from regular income can be for any amount, as long as they:

- Are made from income rather than savings you may have

- Are made regularly

- Do not reduce your standard of living.

You should be aware of the “seven-year rule” on assets you transfer

With the exception of the gift allowances and gifts out of income you read about above, your estate will be liable for IHT on any gifts that are made within seven years preceding your death.

This means that, while the amount you gift to your children or other members of your family is completely up to you, to ensure that it’s tax-free, it’s important to plan when to make that gift.

Effectively, providing you live for more than seven years after you make a gift, your children or family won’t have to pay IHT on that amount when you die.

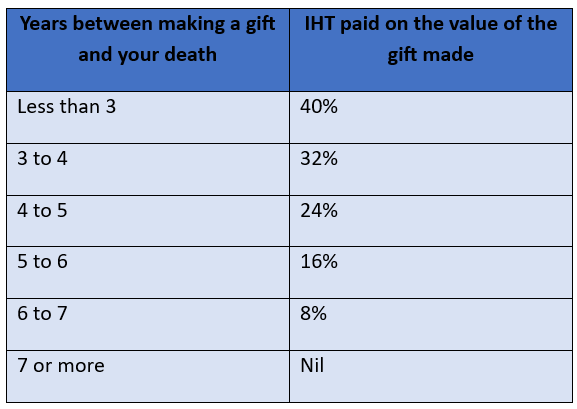

Any IHT to pay, is assessed on a sliding scale known as taper relief.

It’s important to note that taper relief doesn’t reduce the value of the gift transferred – it only reduces the tax payable.

We would also recommend that you keep an accurate record of all gifts you make during your lifetime.

Gifts made to charity are exempt from Inheritance Tax

Any asset, such as cash or a property, that you leave to a registered charity will be exempt from IHT. This applies if you make such a gift during your lifetime or in your will.

The same applies to donations made to political parties.

Such donations can also reduce the rate at which IHT is due from the current rate of 40% down to 36%. However, to qualify for this reduction, the value gifted to charity has to exceed 10% of your “net estate” at the date of your death.

Your net estate is generally defined as the value left over after deducting any exemptions, including your nil-rate bands, along with any other available reliefs.

This can be quite a complex area and we would strongly recommend that you seek expert advice to confirm that any gift you make will qualify.

Gifting assets through the use of trusts

Putting assets, such as property and investments, in trust is another potentially effective way to reduce your IHT liability and to pass your wealth to other family members.

When you put money and assets into a trust, you are giving up your right to them. This means they have left your estate, and the value will not be taken into account for IHT purposes.

However, it’s important to bear in mind that the seven-year rule still applies on assets you put in trust, and they are not totally exempt from any kind of taxation.

For example, if you set up a discretionary trust, there is a 20% IHT charge when the value of the money and assets placed in the trust exceeds your nil-rate IHT threshold.

Different types of trust can be liable for different taxes so, again, we would strongly recommend you speak to an expert for guidance.

Get in touch

If you would like to get expert help with your own estate planning arrangements, including making gifts, please get in touch with us.

Please note

The value of your investments can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not solely rely on anything you have read in this article and ensure that you conduct your own research to ensure any actions you may take are suitable for your circumstances. All contents are based on our understanding of HMRC legislation, which is subject to change.