When you get to a certain age, it’s understandable if your thoughts turn towards your retirement.

This could particularly be the case during the Covid pandemic, which has been tiring and something of a grind for everyone. You may well have had serious thoughts along the lines of “I’ve had enough of this, it’s time to think about retiring and starting to enjoy my life.”

If this is the case, one key question you’re liable to have is: “have I got enough to retire?”

There’s no exact answer, because your individual circumstances will be unique to you. However, read on for five key steps you can follow that will give you a good idea as to whether you have “enough”.

1. First you need to work out how much you have!

Before you know if you have enough, you need to know what you’ve actually got!

This means getting up-to-date values of all your super pension funds, along with any other assets you currently hold. If you have UK pensions, you should get values of those as well.

Bear in mind you normally can’t start drawing tax-free income from your super fund until you are 60. So, if you want to retire before you’re eligible to start taking these benefits, the value of other assets will be important. These could include:

- Your personal savings

- Stocks and shares

- UK-based assets if applicable

- Any inheritance that may be due to you

- The value of your property if you’re planning to downsize.

Don’t forget that “when you retire” is likely to be a joint decision, so don’t forget assets held by your spouse or partner.

2. Then work out how much you need

Once you have a good idea of the value of your assets, the next step is to work out what you’ll need when you stop work.

If you haven’t done so already, set out a schedule of your regular outgoings each month. Clearly some of these will reduce, or disappear completely, once you’re no longer working, so earmark those. This will give you an idea of the level of income your pension and other assets will need to cover.

Also factor in any lump sums you know you’ll be paying out in the near future. As well as any retirement-related spending such as big holidays abroad, these could also include university fees for children or grandchildren, or helping them getting on the housing ladder.

3. Know how long your money will need to last

It’s a good idea to understand how long your money will need to last once you retire.

Obviously, the idea that you know exactly how long you’ll live only happens in the world of science-fiction. However, longevity statistics can help inform your retirement planning so you can take steps to ensure you don’t run out of the money.

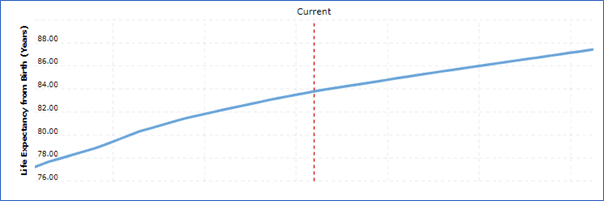

As you can see from the chart, Australian life-expectancy has been rising for the past 30 years and is projected to follow a similar trajectory in the next three decades.

Source: Macrotrends.net Life expectancy in Australia from 1992 to 2052

Current life-expectancy in Australia is 83.79, rising to 84 by 2024. This means that if you retire when you reach age 65, you can reasonably expect at least 19 years of retirement. So, your money will need to last for around that amount of time.

4. Check your investment strategy is still fit for purpose

Having ascertained the value of all your pension funds and other assets, your next step is to drill down to check your investments are still doing the job you need them to do.

We generally preach that any investment strategy should have a long time frame, but if you’re getting close to your intended retirement age, you may need to look to adjust how your funds are invested.

Also be aware that the Reserve Bank of Australia (RBA) forecasts that inflation will reach 2.5% by 2023. This reduces the real value of your super and other investments. It also means that you’ll need to take more out of your fund each year just to stand still in terms of buying power.

So, you may want to consider adjusting your investment strategy to reflect an increasing cost of living.

You may also want to take steps to start planning how you’ll draw income from your assets, and how this could affect your investment planning.

5. What to do if you don’t have enough

So, you’ve done your calculations, and there’s a mismatch between the income you think you’ll need in retirement and what your existing assets will currently provide.

Don’t panic! There are some simple steps you can take to help close the gap.

Continue working and increase your pension contributions

You could carry on working for a time. While you’re doing this, you may want to consider boosting the amount you set aside for retirement each month.

If both you and your partner or spouse are both working, maybe consider staggering your respective retirements to extend the period you’ll be able to set aside savings.

Gradually retire rather than doing it in one go

Consider phasing your retirement by reducing the amount of time you’re working, so you’re still enjoying a relatively quieter life but aren’t drawing too heavily on your retirement funds. You could go part-time in your current job or consider taking on a consultancy role.

You may also find that a gradual retirement is better for you than simply stopping work one day and retiring the next.

Adjusting your retirement spending plans

You can go back through your calculations and see where you could make savings and reduce your expenditure. You may need to adjust some of your retirement plans, but it will mean you’ll be able to stop working and start enjoying your retirement years when you planned to.

Get in touch

At bdhSterling, we have a wealth of experience in helping clients plan their retirement.

Get in touch to find out how we can help you.