If you’re a Brit in Australia, it’s perfectly understandable if you tend to avoid any detailed analysis of the news from home.

However, you may well still retain financial interests in the UK – business or property – or have family there who could be affected by what’s been going on in the last year.

Read about seven of the top financial news stories from the UK in 2021 that you may have missed.

1. The Spring Budget

The chancellor delivered his Spring Budget statement on 3 March 2021.

Although the pandemic was still very much active, there were obvious signs that the vaccine roll-out in the UK was having a positive effect and bringing the spread of Covid under control. So, this was very much a speech that looked forward to the post-Covid recovery and the press described it as a “bounce-back” Budget.

The key announcements made by the chancellor were:

- The Personal Allowance and Income Tax thresholds to be frozen until April 2026

- The Lifetime Allowance also frozen to April 2026

- Corporation Tax on company profits to rise from 19% to 25% in April 2023 for larger firms

- A new “super-deduction” allowing businesses to claim back 130% of the cost of new machinery up to April 2023.

2. Social care spending

There has been mounting concern for many years in the UK at the increasing cost of social care for people in later life. This has been driven by increased longevity and advances in medical technology resulting in people living longer with illnesses that would have previously curtailed their life.

In September, the prime minister, Boris Johnson, made a high-profile announcement that introduced a series of new measures designed to meet the shortfall in social care funding and help the NHS recover from the fiscal impact of the pandemic. These included:

- Working people above the State Pension Age to pay National Insurance contributions (NICs) of 1.25% for the first time.

- A 1.25 percentage point rise in NICs for both employers and employees.

- Dividend Tax is also increasing by 1.25 percentage points.

All these measures will take effect from April 2022.

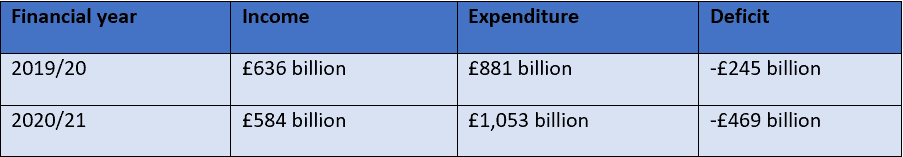

3. The financial impact of the pandemic has been staggering

Various figures published by HMRC during 2021 clearly showed the massive cost to the Treasury of the different steps taken since the Covid outbreak in March 2020.

Source – HMRC

This means that, up to April 2021, the “pandemic deficit” was £714 billion.

In August 2021, the Treasury confirmed that the total UK debt had reached £2.2 trillion. At 106% of current UK GDP, this is the highest ratio since the immediate post-war period.

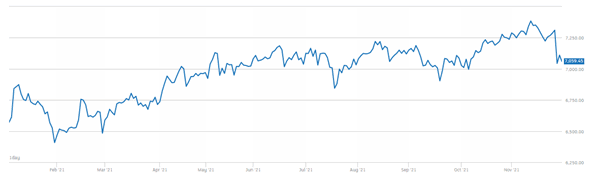

4. UK financial markets continued to recover lost ground

As you can see from the chart below, the FTSE100 has been on a slow upward trajectory in 2021.

By the end of November, it had reached 7,059, up more than 11% since the end of 2020.

Source – London Stock Exchange

However, unlike other major markets around the world, it’s still some way short of its pre-Covid peak.

For example, the ASX200 had recovered to its pre-Covid level by the end of May 2021, even in the face of economic uncertainty caused by ongoing lockdowns in Australia. The Dow Jones and NASDAQ indexes both recovered ground lost due to the pandemic by November 2020.

5. The Autumn Budget

After the key announcements about the freezing of thresholds in the Spring Budget, and the increases to National Insurance announced in September 2021, there were few key announcements in the Autumn Budget.

The chancellor did confirm some macro figures that demonstrated the scale of the impact of the pandemic.

In particular, the Office for Budget Responsibility have estimated that the overall tax burden is set to rise from 33.5% of GDP in 2019/20 to 36.2% of GDP by 2026/27.

This is the highest level since the immediate post-war period.

As an illustration of the post-Covid recovery, the OBR has also estimated that, by the end of 2021, the UK economy will have grown by 6.5% in the previous 12 months.

In 2022 they expect growth to reach 5.1%, followed by 2.1%, 1.3% and 1.6% in the following three years.

6. Inflation is on the rise

In November 2021, the Office of National Statistics (ONS) confirmed that the rate of CPI inflation over the previous 12 months was 4.2%.

Source – ONS

The main drivers for the increase over the past 12 months have been:

- Increased fuel costs

- Increased raw material costs to businesses

- Supply chain issues caused by the pandemic.

The rate of inflation is expected to reach 5% in 2022 before falling again towards the end of the year as some of the factors creating upward pressure ease.

7. Interest rates remain at record low levels

In November 2021, the Bank of England (BOE) kept the bank base rate at its record low figure of just 0.1%.

Source – Bank of England

This is good news for anyone with a mortgage – especially those with a rate that tracks the BOE base rate.

It’s not such good news for savers, who are getting derisory rates of interest on their savings – if any rate at all.

There is continued speculation that the BOE will look to gradually increase the base rate in 2022 to help reduce the rate of inflation down towards its target of 2%.

Get in touch

If you have any questions, or concerns, about how some of the details we’ve highlighted here could impact any financial interests you have in the UK, we’ll be happy to help.

Get in touch to find out how we can help you.